Decades after the US embraced free trade, it’s clear who the losers are

American workers haven’t fared so well in the era of globalisation

It’s not the bias in the media that really matters, but the things they know about, but don’t tell you that really matter. US$750 a month, Netflix and air conditioning. That’s all that’s left and all that you will ever have in the future if you are unemployed, poor, without career prospects and over 40 years old in the US. And you’re probably living in your car stranded at the vast parking lot of a mega-retailer.

...they have only enhanced corporate and financial profits at the price of American workers

I used to fervently support free trade agreements, until I took a realistic look at the numbers and consequences. The North American Free Trade Agreement (NAFTA) cost US workers almost 700,000 jobs. Since the South Korea-US Free Trade Agreement, America’s trade deficit with South Korea has grown more than 80 per cent. That’s equivalent to a drain of more than 70,000 additional US jobs.

Since China’s admission to the World Trade Organization, the US goods trade deficit with China increased US$23.9 billion (7.5 per cent) to US$342.6 billion. However, trade deals fail to deal with currency manipulation or to effectively address labour standards. Ultimately, they have only enhanced corporate and financial profits at the price of American workers.

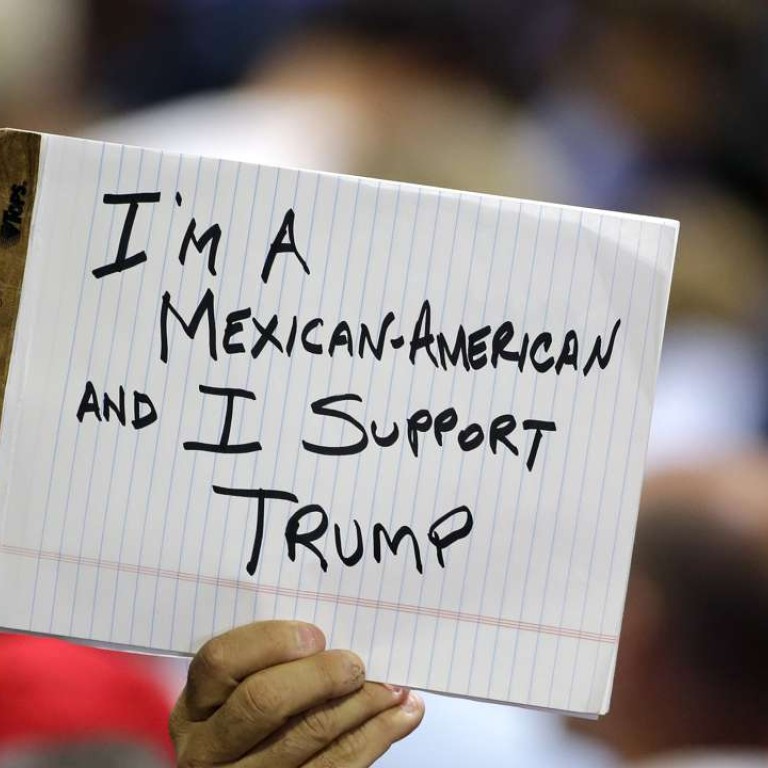

The swelling populist anger in the US assured that Donald Trump seized the Republican nomination. Aiming towards the Presidency, he could continue as the Darth Vader of the politically incorrect aiming his racial alienation beyond Muslims and Mexican-Americans.

Or he could morph into a conventional Republican, forgetting about his anti-free trade threats and the insidious Beltway lobbyists without the incendiary racist, narcissistic, psycho-sexual and self-promotional convulsions. Trump hits out, “On trade, America First means the American worker will have his or her job protected from unfair foreign competition. We’re going to put America back to work. We’re going to make our own products”.

Current and future top policy makers need to cultivate some economic sense during their governing terms. They need to understand how poor economic judgements and decisions reverberate through the fabric of time and history. Let’s step into a time machine consider the following economic blunder committed by Winston Churchill in the 1920s.

After the first world war, if Winston Churchill set aside his Victorian pride in sustaining Britain’s imperial empire and departed from the gold standard, thereby allowing the sterling to float and depreciate freely, it would have taken much longer for American influence to overcome Pax Britannica.

Interest rates would not have declined in America in the second half of the 1920s. No stock market bubble would have percolated so a market crash would not have unfolded. Forget about the Great Depression and Keynes’ economic theories. Hitler wouldn’t have risen in Germany so forget about the second world war and an invasion of China by Japan. Inflation in China wouldn’t have ballooned. There would be no reason for the Nationalist Party to succumb to the Chinese Communist insurgency. Thus, the Chinese Communist party would not be currently running China.

Suppose that the incumbent Beijing policymakers have made an economic mistake similar to that made by Churchill. Sustaining the overvaluation of the yuan in the past few years, perhaps for the greater glory of early yuan internationalisation and IMF entry is fuelling the current internal devaluation pressure in China. This will have far reaching historical consequences when cast alongside Trump’s policy intentions if he becomes President.