Advertisement

What does Trump’s tax plan mean for China? Economists are divided

While some analysts raise the spectre of a stampede of US companies converting their yuan earnings into dollars, other economists say China earnings are meant for reinvestment in the country

Reading Time:3 minutes

Why you can trust SCMP

A day after President Donald Trump’s tax plan for corporate America, more questions than answers remain on just how his vision will affect businesses. Economists and analysts also differed over whether the plan will lead to a flood of repatriation from China, exacerbating the capital flight that had only begun to ease after months of draconian government policies.

The Trump administration’s top economic adviser Gary Cohn and US Treasury Secretary Steven Mnuchin on Wednesday proposed to cut corporate income tax to 15 per cent from 35 per cent and apply a one-time low territorial tax rate on an estimated US$2.6 trillion of offshore profits that American businesses keep overseas.

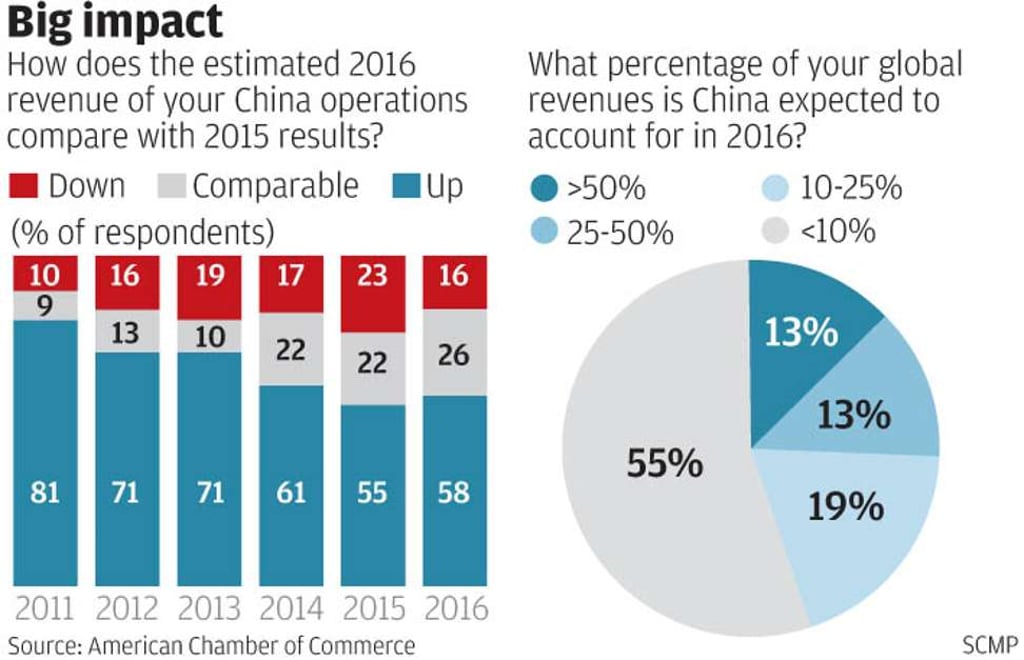

“This will be big in impact,” said Shaun Rein, managing director of China Market Research Group in Shanghai. “Many companies leave their profits outside the US because of tax issues.”

Advertisement

A collective repatriation could lead to a stampede of the yuan for conversion into the dollar before fleeing offshore, testing the Chinese currency regulator’s ability to stem the capital flight.

Advertisement

“While the key is whether the government will let them convert yuan profits out, it’s conflicting with China’s priority to stem capital outflow,” Rein said.

Advertisement

Select Voice

Select Speed

1.00x