China’s lending scrutiny spreads, catching asset buyer Sunac in its wake

China’s banking regulator has ordered commercial banks to check out the developer’s credit exposure, which has been on an aggressive buying spree

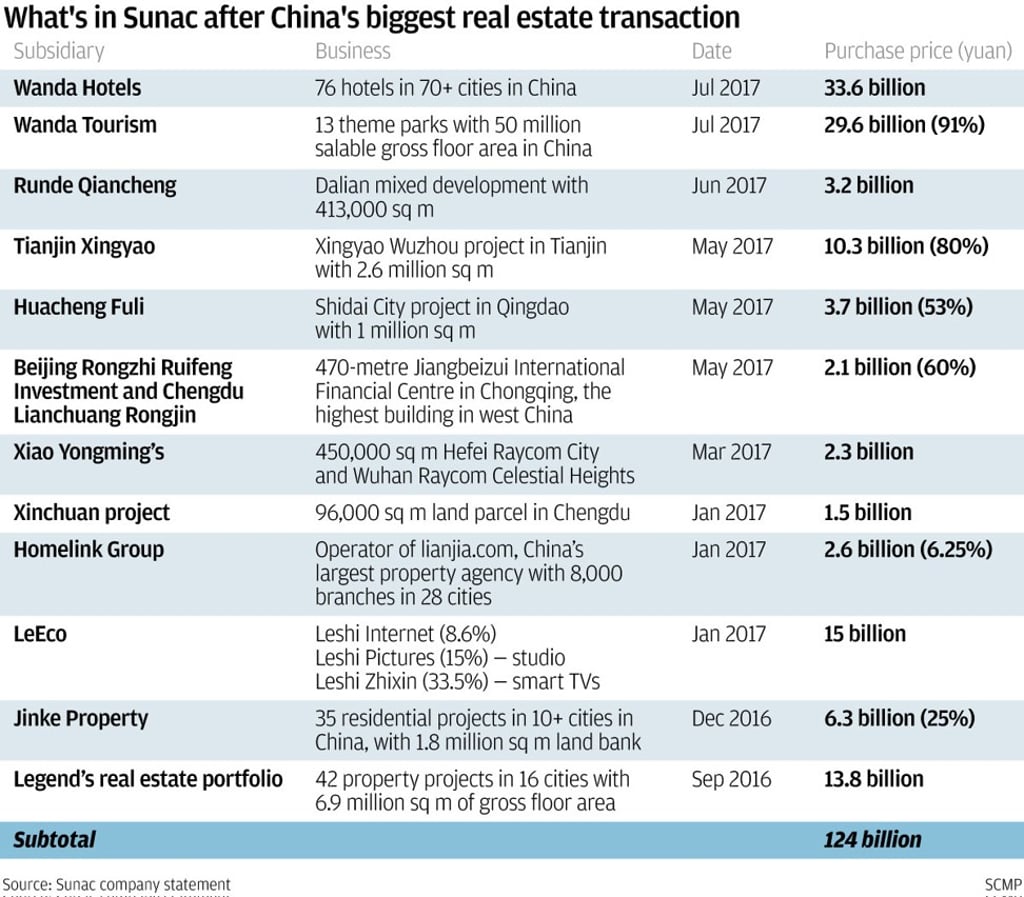

Sun Hongbin, the Shanxi magnate who last week executed China’s largest real estate takeover, has found his Sunac China being caught in the wake of a spreading regulatory scrutiny of Chinese asset buyers, a day after his triumphant election to the board of Leshi Internet Information & Technology Corp.

The China Banking Regulatory Commission verbally ordered commercial banks to examine their credit exposure to Sunac China, according to sources familiar with the matter. The order follows similar instructions delivered verbally on June 20 for banks to look into loans exposures to Wanda Group, which compelled its founder Wang Jianlin to dispose of US$9.3 billion worth of hotels and theme parks last week to Sun.

Sunac is the latest company to be investigated by China’s leaders ahead of a Communist Party reshuffle later this year.

Still, Sun is putting a brave face under the spotlight, saying his company had caught the regulator’s attention because of its huge investment in Wanda. “This is a normal practice by banks,” he said.

In addition, China Construction Bank halted the sale of a Sunac financial product and called off a 1.5 billion yuan trust loan to the company after receiving the regulators’ order to review the company’s credit risks, Chinese news portal Jiemian reported earlier on Tuesday.