Hong Kong must promote research and innovation through incentives, says PwC

City at risk of falling behind neighbours because of lower expenditure on research but changes announced by chief executive offer hope, says consultancy

Hong Kong must catch up or risk falling further behind regional competitors when it comes to innovation and technology, according to consultancy PricewaterhouseCoopers.

“To encourage enterprises to move more R&D [research and development] back to Hong Kong, the government has to employ incentives – and tax incentives are an option,” said Charles Lee, the China south and Hong Kong tax leader at PwC.

“If we do not promote this kind of incentive, the comparative advantage for Hong Kong will be lower than other countries,” he said, noting that if further changes are not considered, companies will simply invest elsewhere. “They can always choose another place to spend on R&D.”

Since taking office as Hong Kong’s first female leader in July, Carrie Lam Cheng Yuet-ngor

has announced a raft of tax changes to guard against the “increasingly grave challenges” posed by global competition.

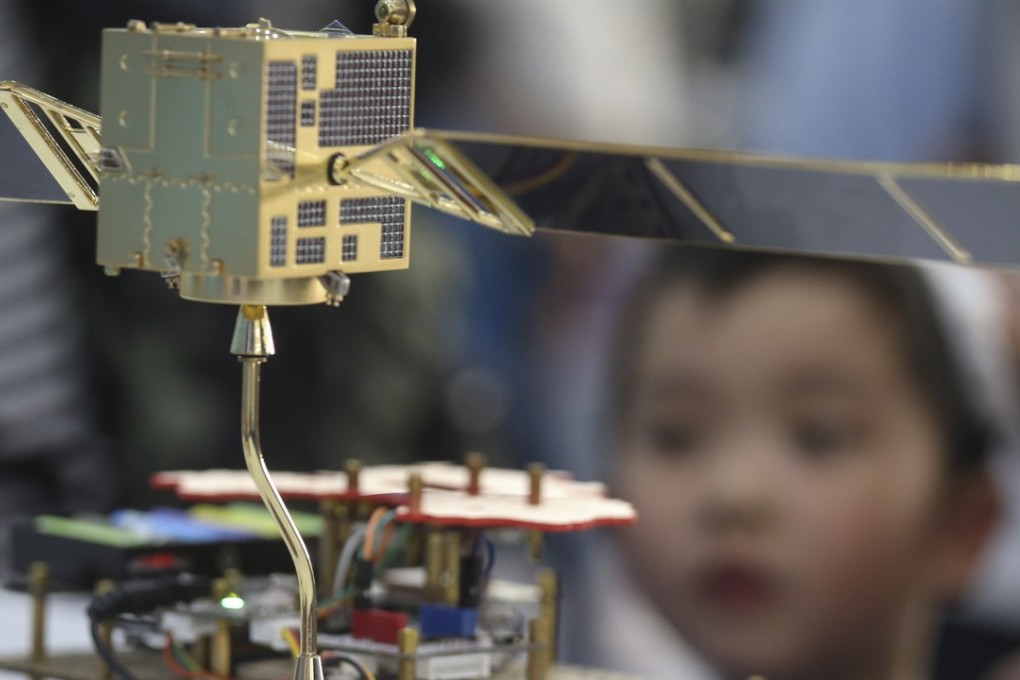

One of these is on the innovation front, where the city languishes in the middle of the pack. Hong Kong now ranks fourth behind the Asian innovations hubs of Singapore, South Korea and Japan – its lowest ever position, according to the Global Innovation Index.

In an attempt to spur further investment in innovation, Lam announced a series of tax breaks for companies that invest in research, to be implemented next year. Under the plan, companies can get a 300 per cent tax deduction on the first HK$2 million they spend – and a 200 per cent tax deduction on expenditure beyond the HK$2 million amount. Currently, companies receive a 100 per cent tax deduction for research expenses.