Chinese companies account for half of top 10 biggest venture capital financing deals in 2017

Last year saw record deal activity backed by venture capital (VC) in China, with half of the top 10 largest deals globally by Chinese telecoms and internet companies.

Topping the list was Didi Chuxing’s US$5.5 billion financing in April, which emerged as the largest VC-backed deal in the past decade.

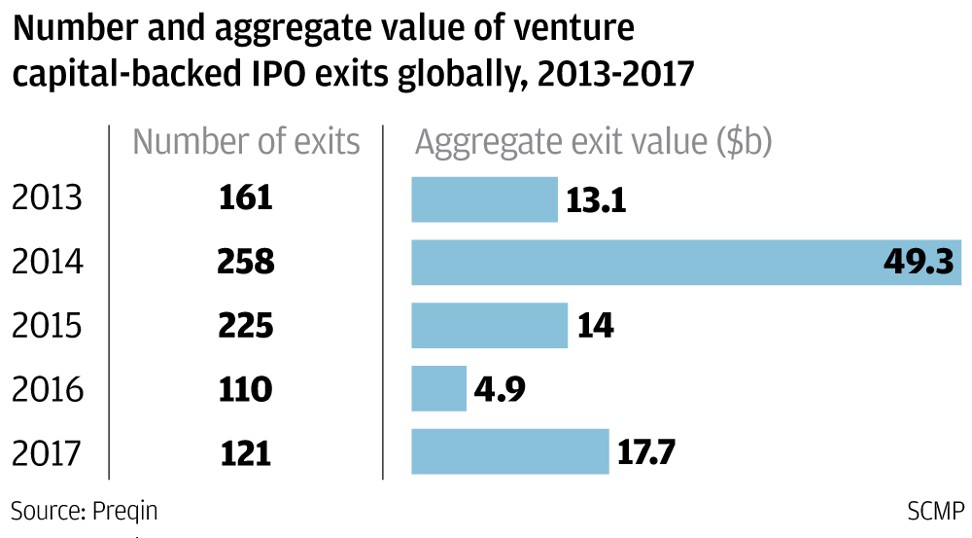

Preqin, a data service provider for the alternative assets industry, expects an uptick in venture capital investors seeking initial public offerings (IPOs) in 2018.

“Spotify [is expected] to become publicly traded in 2018, and other venture capital-backed companies may follow suit. A number of VC-backed companies have now grown to valuations that would make them unlikely candidates for trade sales to corporates … as such, becoming publicly listed is the most likely exit strategy for these companies,” said Felice Egidio, head of venture capital products at Preqin.

Earlier this month, the Swedish music-streaming service filed for a listing on the New York Stock Exchange. Details of the listing are limited, although the company is reportedly seeking a direct listing on the exchange without an initial public offering to raise additional capital.

Investment deals backed by venture capital reached a record US$182 billion globally in 2017, with the value up 28 per cent compared with 2016, even as the deal count dropped 4.7 per cent to 11,144. The US dominated the rankings, drawing 42 per cent, or more than US$76.4 billion. Greater China ranked No 2, attracting 36 per cent of total deal value, with US$65 billion.

Preqin said the 2017 deal number and value figures are expected to rise by up to 5 per cent as more information become available. In 2016 Chinese start-ups accounted for seven out of the top-10 financing deals.

The US$5.5 billion financing to Didi Chuxing, which is Asia’s biggest unicorn – or start-up companies valued at more than US$1 billion – also amounted to the largest Asia-based VC deal on record. Investors included the Bank of Communications, China Merchants Bank, Softbank, and Pagoda Investment.

Meituan-Dianping ranked as the fourth largest deal after it raised US$4 billion in October from sponsors IDG Capital, Sequoia Capital, Tencent, and GIC among others.

In 2017, exits deals backed by venture capital – or the method by which a venture capitalist cashes out of a business – amounted to US$71 billion. Of these, 676 exits amounting to US$51.7 billion were completed in North America. China completed 60 exits valued at US$5.6 billion.

But when it comes to fund raising, 2017 stopped short of being the best record for venture capital. For the year, venture capital funds raised US$55 billion while growth funds raised US$39 billion, both lower than in 2016.