Hong Kong Monetary Authority chief Norman Chan rejects calls to relax mortgage policies

Lawmakers question ‘spicy policies’ during Financial Affairs Panel meeting on Monday

Hong Kong Monetary Authority chief executive Norman Chan Tak-lam on Monday rejected calls by lawmakers to relax mortgage policies, saying the city’s property market was still too overheated for any such relaxation.

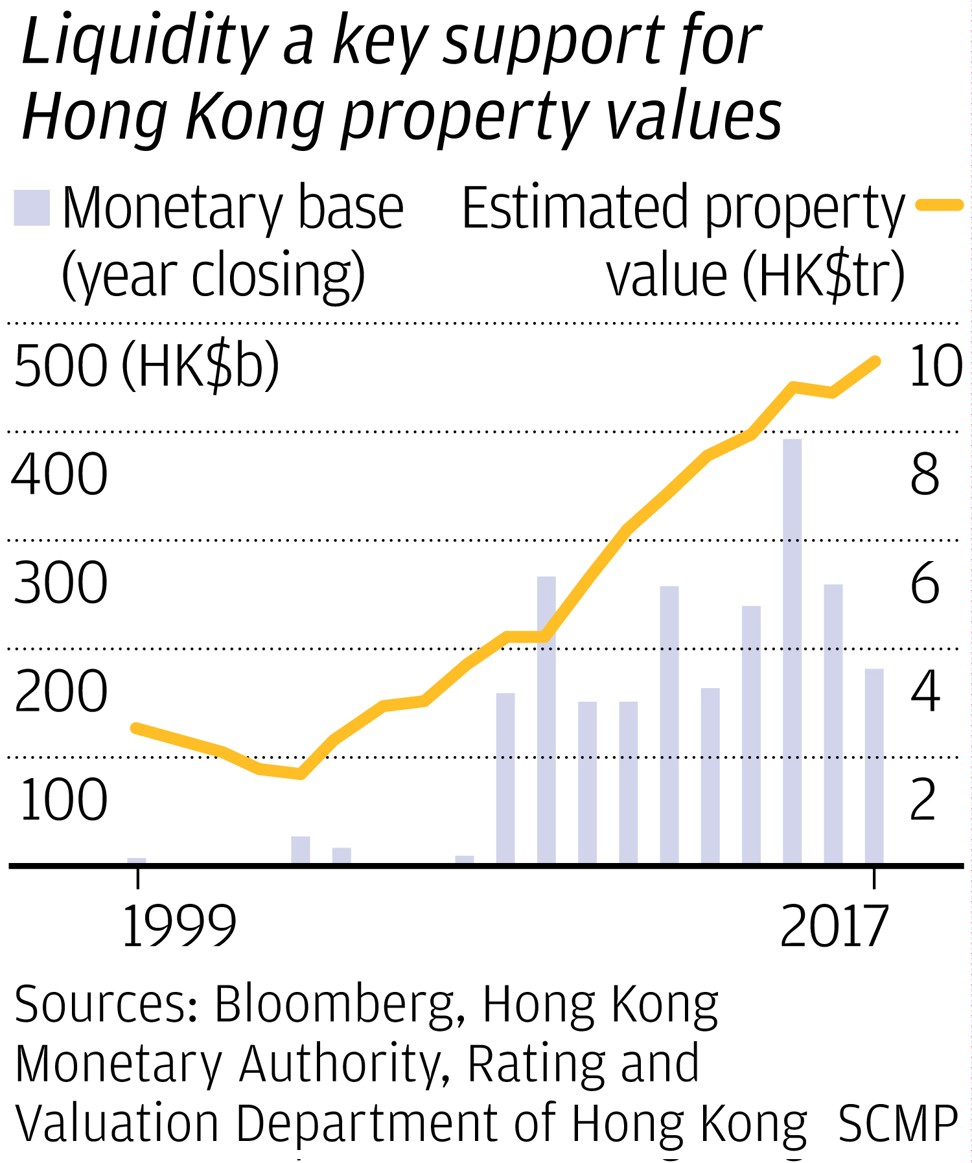

The authority, Hong Kong’s de facto central bank, has introduced eight rounds of mortgage tightening policies since 2009 to crack down on speculative activity. The public refers to these as “spicy policies”.

Chan was grilled in the monthly Financial Affairs Panel meeting, and asked why these policies had failed to cool down property prices while making it difficult for individuals and small companies to buy homes or offices.

“The more spicy the mortgage policies, the higher the increase in property prices. It looks like the spicy policies do not work. Some bankers are saying the property prices will not drop even if the interest rate were to rise to 2 per cent,” said Wong Ting-kwong, a lawmaker who represents the import and export industry.

Wong called for the Hong Kong Mortgage Corporation, part of the HKMA via the Exchange Fund, to relax the mortgage insurance programme to allow small companies to borrow more to buy offices and, hence, improve their cash flow.

Other lawmakers called for the HKMA to widen the Mortgage Corporation’s programme to allow those who buy properties between HK$4 million (US$511,436) and HK$6 million to be able to get a mortgage loan equal to 90 per cent of the valuation of the property, so that they would need a smaller amount for the down payment. At present, the programme only allows 90 per cent mortgage loans against properties worth under HK$4 million – but few properties are sold at this level.

Chan said it was not the right time to do so. “We have to ask the question, if there were no spicy policies, would property prices go even higher? We do not consider the current market condition as a situation in which we can relax mortgage policies,” Chan told the meeting.

“We need to carefully consider what would be the implications for the property market if we relax the mortgage insurance programme. It might lead people to buy property at a high time, while property owners might ask more aggressive sales prices,” he said.

Chan said property prices might come down as the United States has started to increase interest rates, which Hong Kong might follow. He said strong employment figures had led to losses in the US market on Friday, which led the Japan and Hong Kong markets down on Monday.

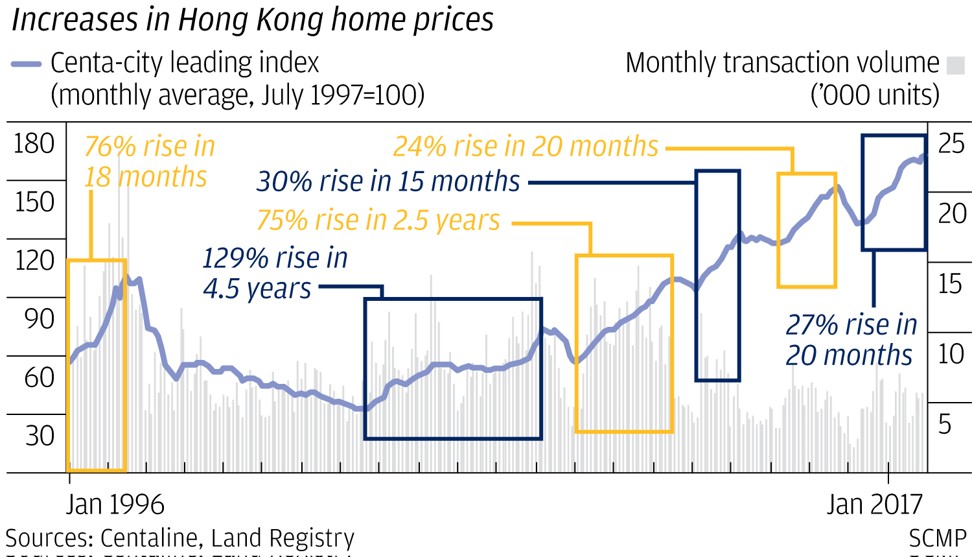

“The property market is still on a bull run and people might think property will only go up. But in fact, the record in 1997 has shown property prices could go down substantially in a downward cycle.”

Hong Kong home prices surged for a 21st month in December – their longest stretch of gains since 1993 – driven by strong demand in small flats, according to the Rating and Valuation Department.

Smaller units, under 430 square feet, with lower price tags led the increase in home prices in 2017, according to credit rating agency S&P Global.

Developers normally offer up to 80 per cent loan-to-value mortgages for such properties, higher than the normal bank offering of 70 per cent loan-to-value, which has attracted a new segment of buyers who cannot afford down payments, or lack the credit profile to obtain a mortgage from commercial banks.

“This segment has inflated the per square foot prices of some smaller units to higher than those of larger units, and could be particularly susceptible to increases in interest rates,” S&P said.