Chinese investors warming up to impact investing, but regulations slowing progress

International money is still the driving force when it comes to investing to achieve positive social and environmental outcomes

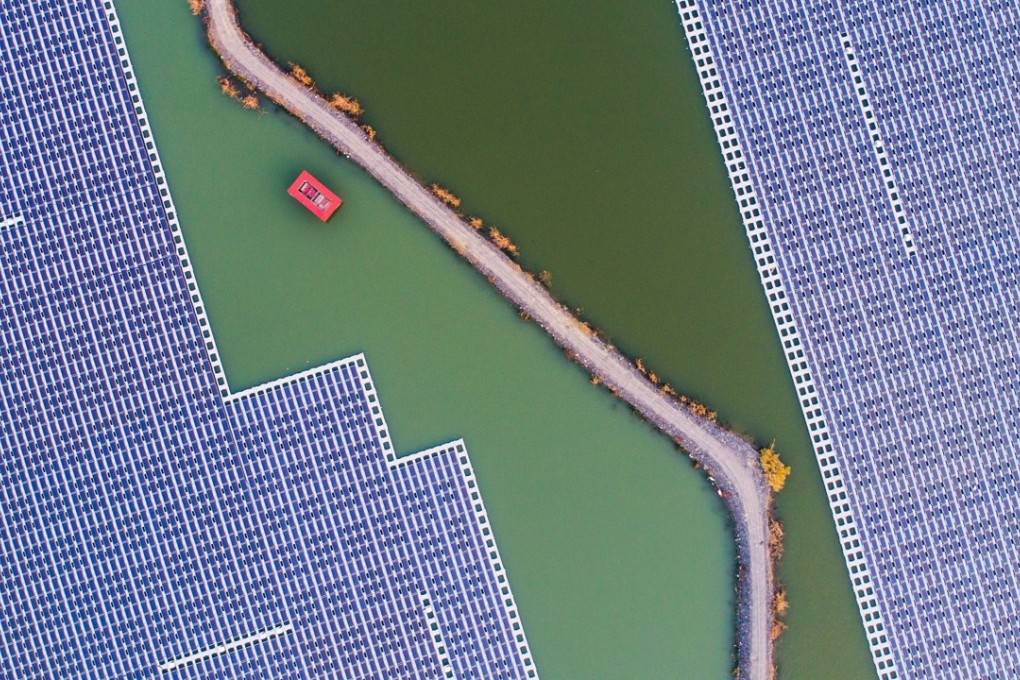

Chinese investors are showing increasing interest in start-ups with innovations that tackle energy consumption, social and climate change issues, but the main force behind such so-called impact investing remains foreign firms and supranational agencies, according to fund managers.

Regulations in China that prevent foundations established for non-profit reasons from using their funds to invest into for-profit businesses are one hurdle, while fund-of-fund managers, and family offices in China are only just starting to take note of impact investing.

Speaking at a private equity conference in Beijing, Amanda Zheng, principal at China Impact Ventures – which focuses on early-stage investment into energy technology in China, said there are social enterprises and charitable foundations in China that are keen on allocating capital to her fund, but which have run into regulatory issues.

“These foundations have a lot of green projects on their agenda, but many of them are still struggling with regulations,” she said, adding that similar restrictions do not exist in markets such as Hong Kong.

“For impact investing in China, the major investors are still international players,” she said.

Impact investing aims to generate positive social and environmental outcomes alongside a financial return, and can include areas such as education, affordable housing and services that promote financial inclusion.