Can Hong Kong’s free-falling real estate market avoid the cliff, as deep-pocketed Chinese tourists and companies stay away?

- China, itself caught up with the pandemic, might not be best placed to help city’s economy

- Hong Kong has come to the aid of individuals and companies affected by the outbreak, but has not addressed the issue of commercial and residential land supply

Eric Pau, senior associate director at one of Hong Kong’s biggest real-estate agencies, vividly remembers the last time a global pandemic brought the city’s property market to its knees.

A 23-year-old property salesman at the Amoy Gardens housing estate in Kowloon Bay in 2003, Pau said he could feel the panic spreading through the neighbourhood when 321 of the 19,000 residents in the estate’s 19 apartment blocks caught the severe acute respiratory syndrome (Sars).

“Nobody would go and view flats. People tended to rent instead of buy at that time,” said Pau, who is with Ricacorp Properties. “Those living at Amoy wanted to move out or buy somewhere else. People were scared. There were not many clients at that time.”

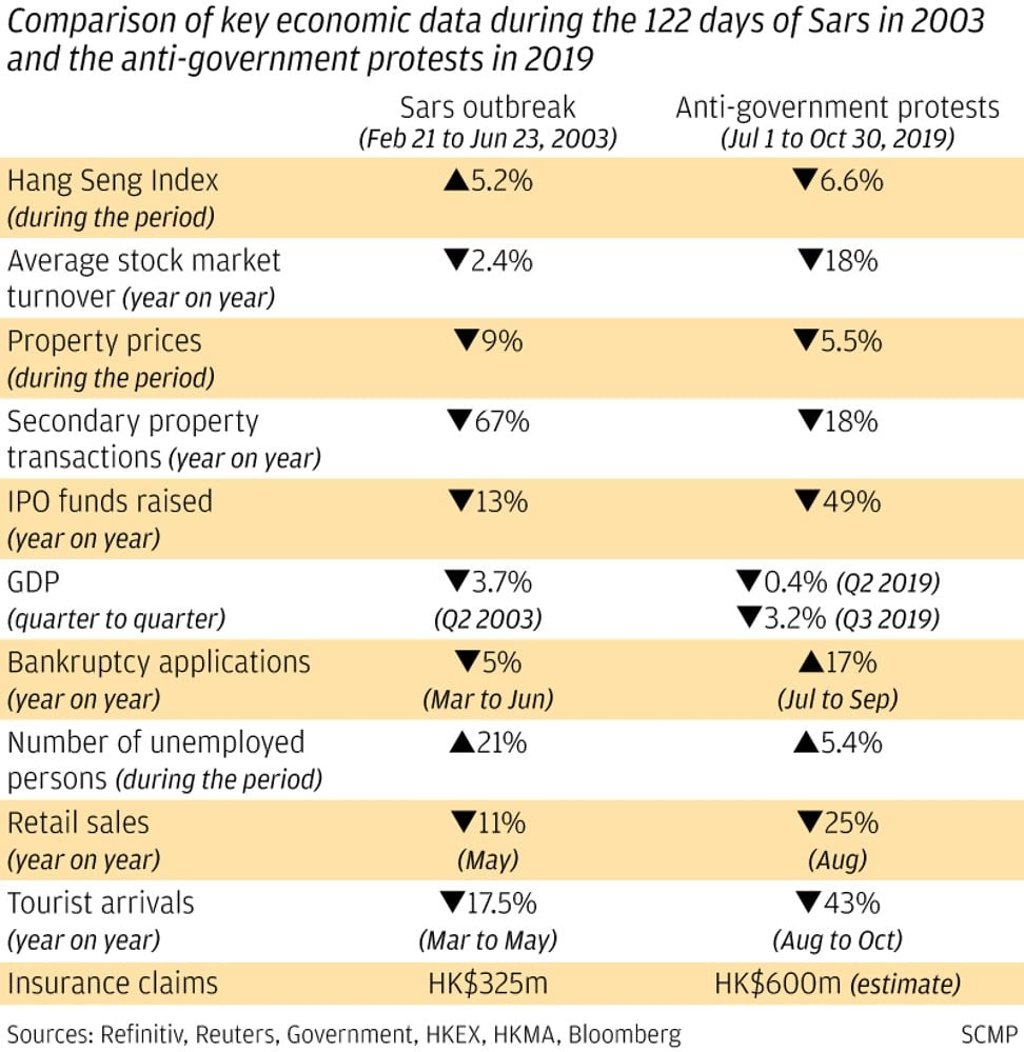

The Sars outbreak, which sickened 1,755 people and claimed 299 lives over 122 days in the spring of 2003, drove Hong Kong’s median home prices down by 11 per cent by June. A flat measuring 390 square feet (36.2 square metres) at Amoy Gardens sold for HK$500,000 (US$64,000), a 38 per cent discount to prevailing prices in 2003, piling weight on a market that was already in free fall from its October 1997 peak. The accumulated decline amounted to an unprecedented 68 per cent.

The experience of Sars is seared on Hongkongers’ collective memory, making surgical masks and regular disinfection of public amenities a part of the city’s daily routine. Now, the housing market, where monthly payments towards either rents or mortgages make up between 25 per cent and 60 per cent of gross income, is again under the gun, as the second coronavirus pandemic to ravage the world burns its course through the city.