Sinopec expects fuel demand to recover from Covid-19 drop-off in second quarter, as it reports 27 per cent profit growth

- The petroleum and chemical giant is maintaining relatively high inventory to prepare for demand recovery, after refinery utilisation dipped in recent weeks

- Price increases of 62 per cent and 15 per cent for oil and natural gas, respectively, drove profit growth in the first three months of the year, the company said

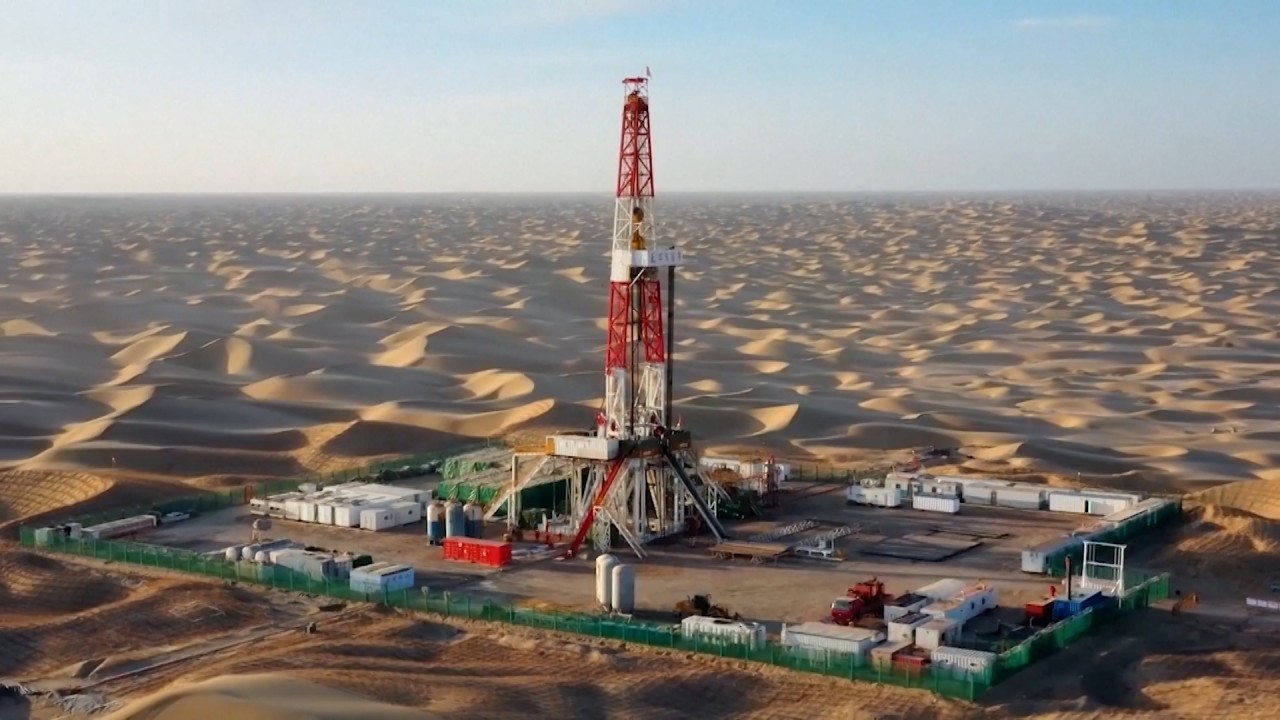

China Petroleum & Chemical (Sinopec) expects fuel demand in the world’s second largest economy to gradually recover later this quarter, after its refinery utilisation rates and cash flows were hit by city lockdowns and logistics hiccups.

The company, the world’s largest oil refiner and fuel producer, saw the average usage of its refining plants decline to around 85 per cent in recent weeks from 92.6 per cent in the first two months of the year, Huang Wensheng, secretary to the board of directors, told analysts and reporters on Thursday.

“The company is maintaining a relatively high inventory level to prepare for the post-pandemic demand recovery,” he said.

Late on Wednesday Sinopec posted a 27 per cent year-on-year growth in net profit to 22.45 billion yuan (US$3.41 billion) for the year’s first three months, thanks to 62 per cent and 15 per cent jumps in the selling prices of oil and natural gas, respectively.

The company forecasts solid demand for the whole year despite the recent drop, based on its experience with the severe acute respiratory syndrome (Sars) epidemic in 2003 and the first wave of the Covid-19 pandemic in 2020. In February 2020, for example, its refinery utilisation plunged to 66 per cent from 91 per cent a month earlier.

“From these episodes, we learned that fuel consumption did rebound once the disease’s spread is under control, and often strongly,” said Li Li, deputy head of the company’s operation management department.

“As we have already seen a downward trend in Shanghai’s Covid case numbers, we expect demand will gradually recover in the second quarter, and are confident that demand will be higher in the whole of this year compared to last year.”

As many as 45 cities in China were implementing full or partial lockdowns by April 11, covering 373 million people – over a quarter of the population – and just over 40 per cent of its economic output, according to data collated by Nomura.

The investment bank’s economists have slashed their forecast of the nation’s second-quarter economic growth to 1.8 per cent from 3.4 per cent, a marked slowdown from 4.8 per cent in the first quarter.

Sinopec said its refining operating profit rose 15 per cent to 22.9 billion yuan in the first three months, but expects it to fall in the second quarter.

“In the first quarter, we managed to pass on some of the higher crude-oil costs to customers, and we booked valuation gains on our inventory, so we enjoyed a profit margin of US$13 per barrel,” Huang said. “The margin will be lower in the second quarter largely because there will be no inventory gain.”

The company has also booked 1.6 billion yuan of losses in the first quarter – 1.2 billion yuan more than in the same quarter last year – on imported natural gas, because of elevated prices stoked by Western sanctions against Russia for invading Ukraine, said Song Zhengguo, deputy head of the finance department.

Cash flows declined by 31.6 billion yuan year-on-year in the first quarter, with Song citing inventory build-up caused by logistics challenges during the lockdowns.

Sinopec shares closed the morning trading session 1.8 per cent higher at HK$3.89.