Outgunning the West

China's Big Four banks continue to post higher returns than their US and European rivals, with regulations helping to cement their positions

Mainland China's largest banks capped a sixth year of record profits by posting a 21 per cent average return on equity (ROE), more than twice the rate earned by US and European competitors led by JP Morgan Chase.

Government controls on interest rates and limits on foreign banks' operations helped buoy profits at China's state-owned lenders even as the economy slowed. Western rivals, in contrast, were weighed down by regulatory probes and a crackdown on proprietary trading. JP Morgan was hurt by US$6.2 billion of trading losses, while HSBC joined banks fined for offences from rigging rates to money laundering.

"It's a very regulated market" in China, said Mike Werner, an analyst at Sanford C. Bernstein. "It's very difficult for foreign banks to expand and that has essentially assured the domestic banks of getting a very healthy portion of the overall business."

China's banks boosted credit last year to fend off slowing profit growth and the threat of rising defaults after the economy expanded 7.8 per cent in 2012, the slowest pace in 13 years. Growth may accelerate this year and next as the nation ushers in new leaders who plan to continue with reforms, according to the Organisation for Economic Co-operation and Development.

China's cabinet yesterday said it will take steps to loosen state control over interest rates and the yuan.

Shares of the four biggest Chinese banks - ICBC, China Construction Bank, Agricultural Bank of China and Bank of China - have gained 29 per cent in Hong Kong trading since mid-September as the United States announced a third round of quantitative easing and investors bet on an economic recovery.

The return on equity for some global banks, which had exceeded 20 per cent from 1997 to 2007, has plummeted to less than 10 per cent as the firms bolstered capital levels to meet regulatory requirements while legal costs and slow economic growth weighed on earnings. "Chinese banks are in much better shape than their counterparts in most developed countries," said Sandy Mehta, chief executive of Value Investment Principals. Their "ROEs have been remarkably resilient in the face of a slowing economy", and will probably be sustained as China's growth revives, he said.

Foreign banks have 387 branches in China, compared with about 65,000 operated by the four largest local lenders at the end of 2011, according to the China Banking Regulatory Commission. The global firms held less than 2 per cent of banking assets in China and have so far reaped bigger profits from their investment in local lenders than from their own franchises. China's four state-run lenders, all of which are based in Beijing, were transformed from almost insolvent institutions with spiralling defaults a decade ago, with the help of more than US$650 billion in bailouts. They went on to raise a combined US$64.5 billion through first-time share sales starting in 2005 and now rank among the 10 biggest by market value in the world.

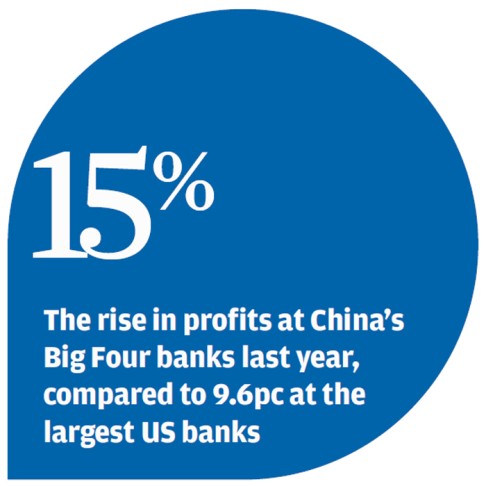

On Wednesday, ICBC, the world's most profitable lender, reported 15 per cent growth in net income for 2012, and a return on equity of 23 per cent. Still, its profit growth was the weakest since its shares started trading in 2006.

At Construction Bank, the second-largest, profit grew 14 per cent. Agricultural Bank, ranked No3, posted a 19 per cent increase, while Bank of China's earnings rose 12 per cent.

Combined profits at these lenders may increase 4 per cent to US$120 billion this year, compared with a 31 per cent increase to US$67.9 billion for their US rivals, according to analyst estimates.

Meanwhile, non-performing loans at Chinese banks increased every quarter in 2012 to hit 492.9 billion yuan as of December 31 from 427.9 billion yuan a year earlier, according to the mainland's banking watchdog.

Changes in economic conditions will show up in banks' profits and asset quality with a lag of six months to a year, said ICBC president Yang Kaisheng.