Bank chief probed over secret deals

Austrian executive allegedly used Hong Kong firm to buy Singapore flats

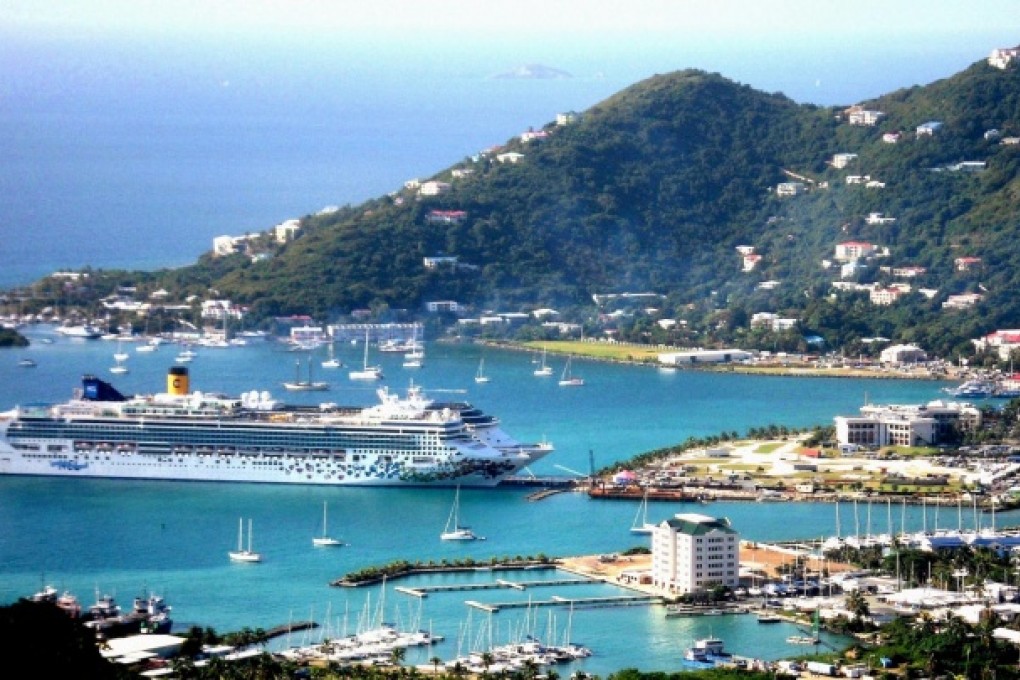

Even as the European Union toughens its measures against tax evasion and offshore havens, an Austrian bank has confirmed it is investigating its chief executive for using companies in Hong Kong and the British Virgin Islands (BVI) to conduct property deals he did not report to his employer.

Raiffeisen Bank International chief executive Herbert Stepic owns a Hong Kong firm, Takego, and a BVI firm, Yatsenko International, which he used to buy three flats in Singapore, said a Reuters report that a spokesman for the bank confirmed was accurate.

Raiffeisen, with 60,000 employees and 14.2 million customers, is the only Austrian bank with offices in Asia, including Hong Kong, mainland China and Singapore, according to its website.

This European Council managed to unblock a number of frozen files [on tax evasion]. There is a real acceleration, with clear deadlines

A search of the Hong Kong corporate registry found Takego was owned last year by a Hong Kong firm, Lintel Securities, wholly owned by David Chong Kok Kong, the chairman of Portcullis Trustnet, a financial services firm based in Singapore.

Portcullis was a major source of information on secretive offshore companies that was provided to the United States-based International Consortium of Investigative Journalists in one of the biggest financial leaks in history.

On March 21 this year, Lintel resigned as a director of Takego, which was incorporated on November 12, 2007, Hong Kong corporate records show.

Searches of the latest available corporate records, which may not show current affiliations, found Stepic listed as a director of only one Hong Kong firm, Raiffeisen's local branch.