Advertisement

Monitor | Beijing's latest rate reform makes no difference at all

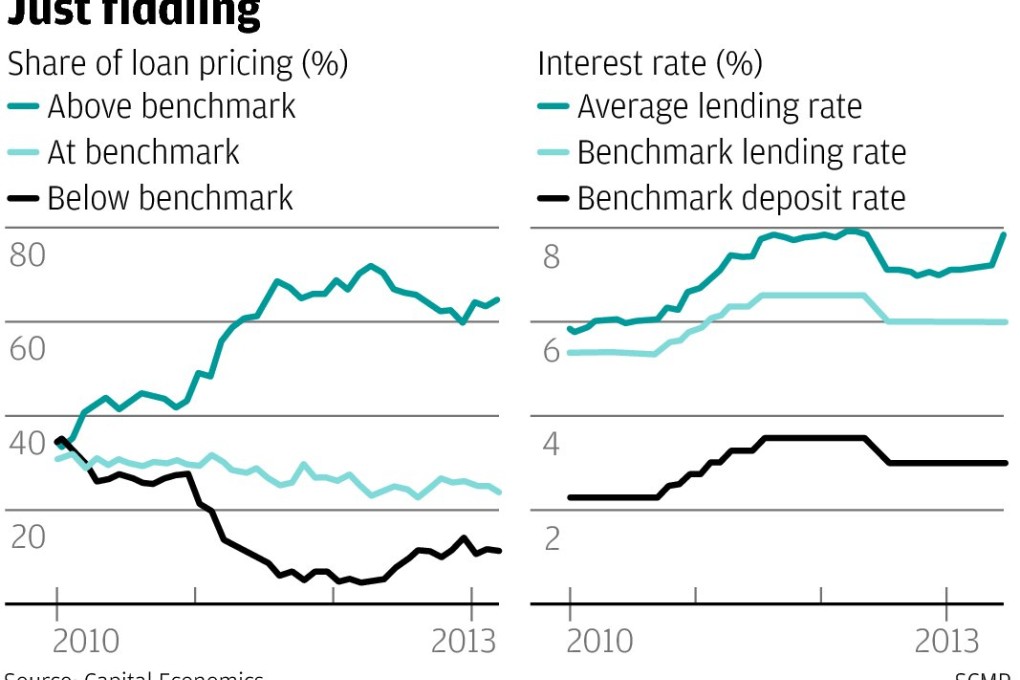

Fiddling with lending rates will have little impact as long as credit continues to be allocated according to government-determined quotas

2-MIN READ2-MIN

On Friday evening, the People's Bank of China announced it would scrap minimum lending rates for the banking sector.

"A major step in the financial and monetary reform process," gushed British bank RBS.

Advertisement

"These moves reflect the will of the new leadership in financial liberalisation," declared Goldman Sachs.

"Perhaps China's most important step towards financial market liberalisation in many years," added research house Capital Economics.

Advertisement

Please forgive me if I manage to contain my excitement.

Advertisement

Select Voice

Select Speed

1.00x