Monitor | Hong Kong should scrap its stamp duty on share trading

The 10 basis-point rate may not sound like much but it is easily enough to discourage high-frequency traders from dealing in the city's market

To support its unsuccessful attempt to list in Hong Kong, Chinese internet retail giant Alibaba argued that the city's share of Asian stock market trading was in severe decline.

A high-profile initial public offering from a big technology company, insisted Alibaba executives, was just what the Hong Kong stock exchange needed to revitalise its flagging market.

It is true that trading activity in Hong Kong-listed shares is relatively limp by regional standards.

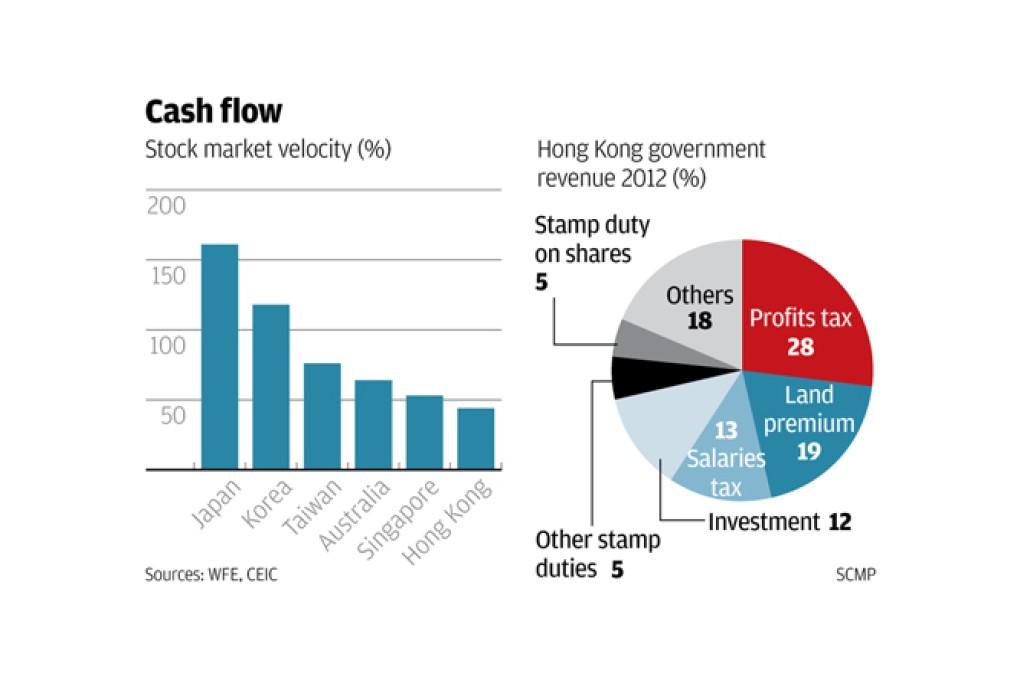

In the first nine months of this year, Hong Kong's average market velocity - the value of shares traded each month as a proportion of total market capitalisation - was just 44 per cent.

As the first chart shows, that's the lowest among East Asia's major stock markets. In contrast, Japan's market velocity is almost four times as great at a blistering 161 per cent.

But the reasons activity in Hong Kong is so limp have nothing to do with a shortage of attention-grabbing offerings.