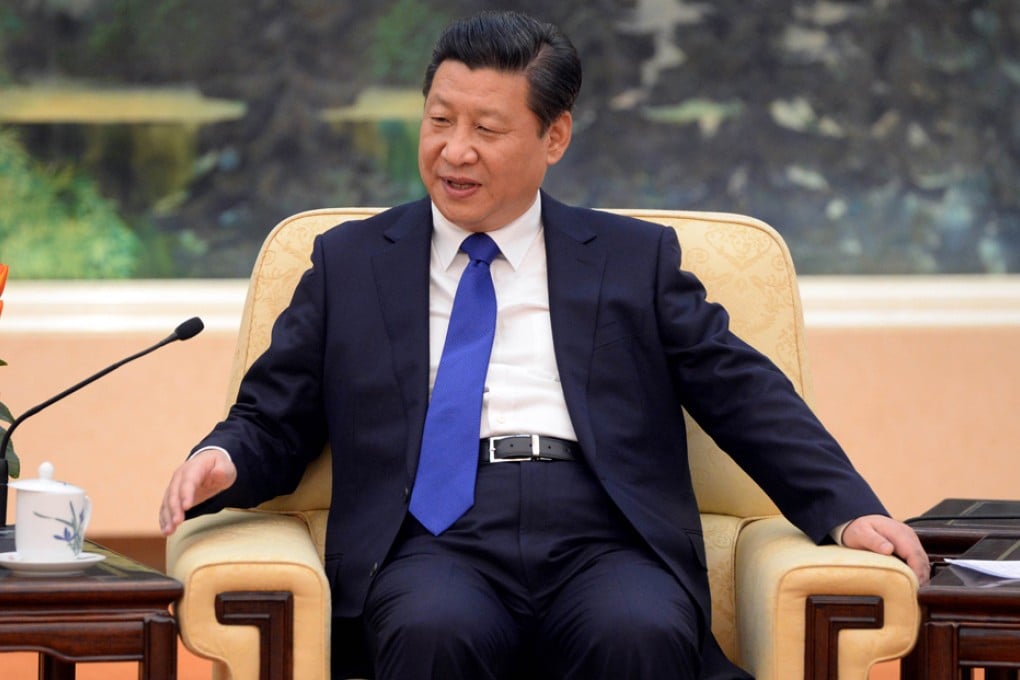

Analysis | Xi Jinping's security commission to also tackle financial industry

Fears speculative foreign capital could threaten domestic stability one reason for top-level division within new National Security Commission

The move comes as the world's number two economy is increasingly worried about speculative capital flows that may threaten domestic stability.

Xi's vision of the NSC was expected to focus on "all kinds of emerging and new threats that the government hasn't spent too much time and resources on yet", a source said.

Financial industry security would fall into the "emerging threat" category.

"We do have several different departments to tackle financial security matters. For example, the State Administration of Foreign Exchange has been monitoring 'hot money' closely, and the Ministry of State Security has a team of experts to deal with related problems," said a government source familiar with the situation. "But if we compare our efforts with some big Western countries, our leaders believe we still have a lot more to do with financial security, which is proving to be a serious threat not just to China but also to other countries amid the growing trend for economic globalisation."

Shi Yinhong , an international relations professor at Renmin University, said representatives from the financial sector would be included in the NSC.