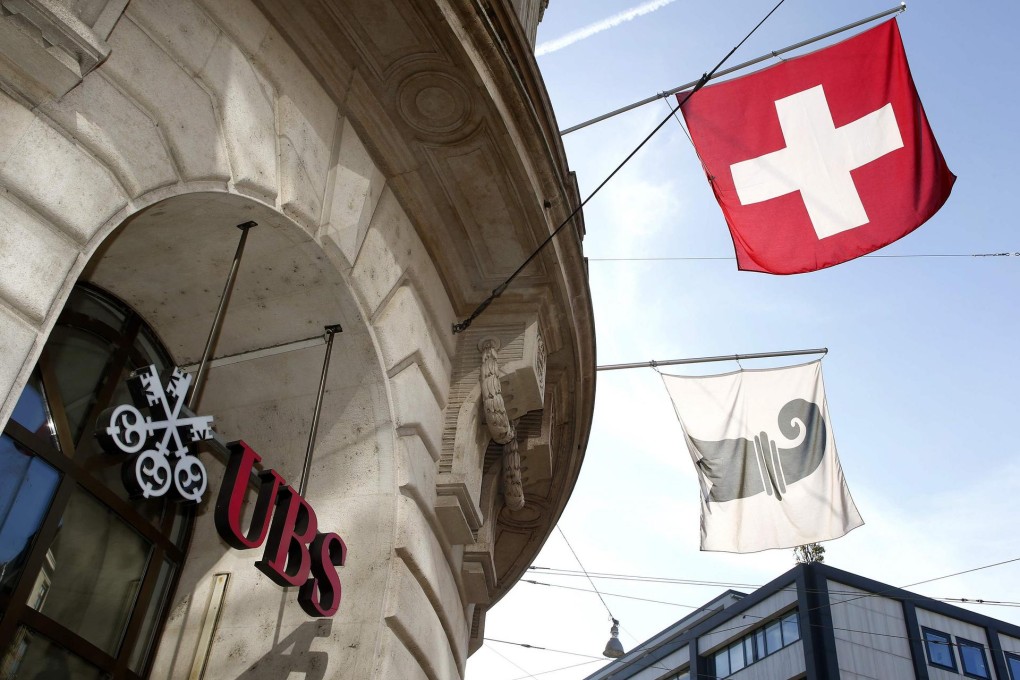

UBS, trying to repeat its success in limiting fines in a probe of interest-rate rigging, is seeking immunity in the United States and European Union as part of the global investigation of currency markets, two sources said.

The Zurich-based bank saved itself billions of euros in fines in December by disclosing to the EU its role in manipulating the London interbank offered rate. Now, the bank aims to be the first to report its own conduct in currency markets to European and American regulators, the sources said.

It is making its bid for leniency as at least 12 regulators probe allegations that traders colluded to rig benchmarks in the US$5.3 trillion-a-day currency market. The world's biggest banks are under scrutiny, and at least 21 people have been fired or suspended as a result.

"They've been through the drill and understand the benefits of co-operation," said Douglas Tween, a lawyer at Baker & McKenzie and a former lawyer with the US Department of Justice. "You want to limit your exposure as much as you possibly can."

UBS said in a filing last year that it began a review of its currency operations in June after media reports on potential manipulation of the WM/Reuters rates used by companies and investors around the world.

UBS, Switzerland's biggest lender, is among the top four currency-trading banks, according to a May survey by Euromoney. UBS spokesman Gregg Rosenberg declined to comment on any contacts with regulators involving the probes. The firm said in a regulatory filing it was co-operating with all investigations connected to currency trading.