Ong brothers' RRJ to challenge lead of Western private equity funds

Reaching US$4b target for third fund would see RRJ vault into ranks of Asia's biggest firms

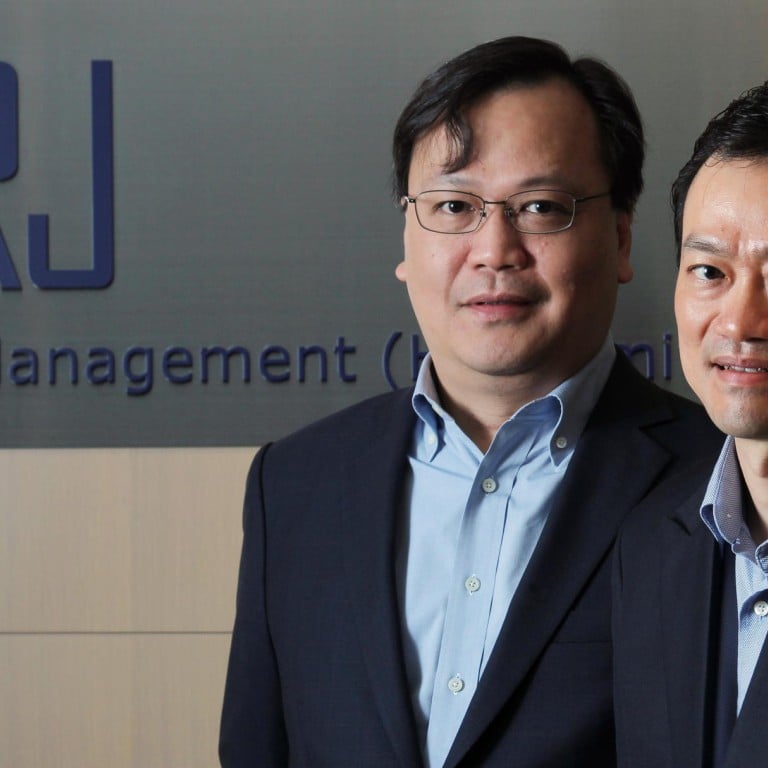

With its latest fund, RRJ Capital, a private equity firm run by former Goldman Sachs partner Richard Ong, aims to become one of the biggest homegrown private equity firms in Asia, challenging the dominance of Western players in this region.

If RRJ accomplishes its goal of raising US$4 billion for its third fund by the end of July, it will have nearly US$10 billion of assets under management, making it one of the biggest homegrown private equity firms in Asia, said an RRJ executive who declined to be named.

CDH Investments, which describes itself as one of the largest alternative asset management firms focused on China, managed just over US$14 billion of assets as of the end of 2013, according to its website. Affinity Equity Partners, an Asian buyout fund manager, manages more than US$7 billion of assets, making it "one of the largest independent financial sponsors in this region", according to its website. Hony Capital, a private equity firm sponsored by Legend Holdings Corp of China, manages US$7 billion, according to its website.

Even five years ago, Asian private equity firms were much smaller than leading Western private equity players like TPG, KKR and Carlyle, the executive said. "Now Asian PE firms are starting to challenge the international guys. Ten years ago, when you bought a cell phone in Asia, it would normally be a Western brand like Nokia and Motorola. Today, Xiaomi [of China] is a very popular brand. It's the same with PE firms."

In 2013, KKR closed its US$6 billion Asian fund, the biggest ever Asian private equity fund at that time.

RRJ already has US$3 billion of soft commitments for its third fund, of which more than half came from North American pension funds while the rest are from Asian and Middle Eastern sovereign wealth funds as well as European pension funds, the executive said.

"Our strategy is investing in growth companies and state-owned enterprises. Our focus is on food, environmental services, logistics and information technology. Geographically, 75 per cent of our investments will be in China and 25 per cent in Southeast Asia," said the executive. RRJ intends to launch its third fund over the next four to five years, he added.

The first RRJ fund, of US$2.3 billion, achieved a net internal rate of return of more than 20 per cent, while that of its second fund of US$3.6 billion is in the mid-20 per cent range, the executive said.

Richard Ong's brother, Charles Ong, now a co-chairman of RRJ, was formerly a chief investment officer and chief strategy officer of Singapore's sovereign wealth fund Temasek Holdings.