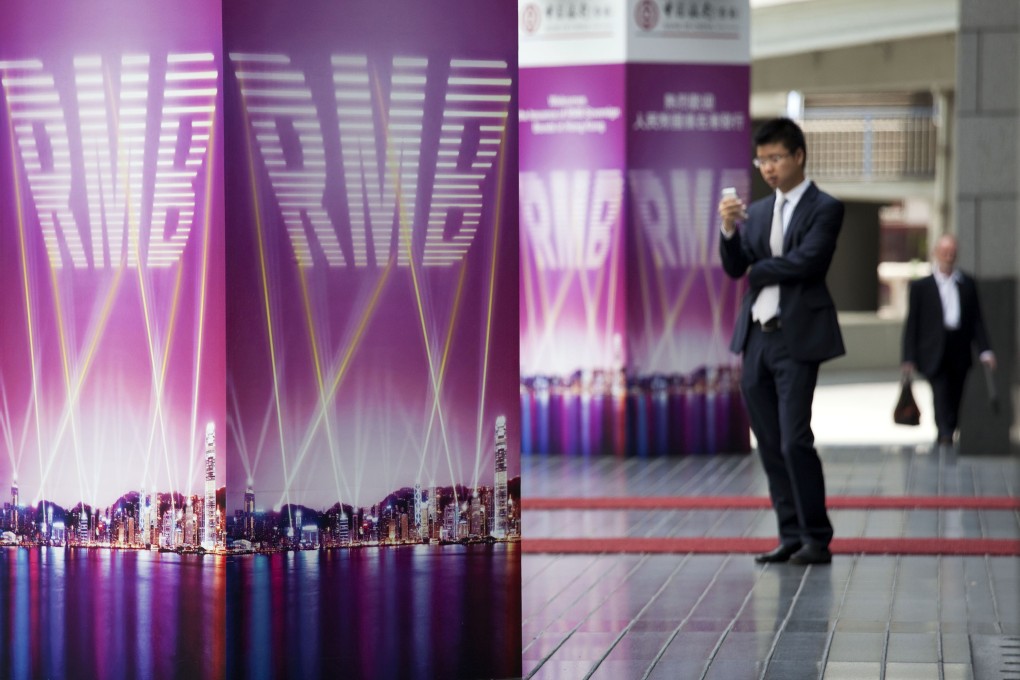

Offshore yuan bond issuance in HK shrinking for first time

Offshore yuan bond issues are set to fall this year for the first time since the Hong Kong market began in 2007 as funding costs have become more expensive than in mainland China.

The dim sum market, as the offshore yuan bond market is known, had expanded rapidly since its inception because borrowers could raise money more cheaply in Hong Kong – a trend that now looks set to end.

Offshore funding costs rose sharply late last year after Beijing approved new channels to let yuan flow back to the domestic market.

Becky Liu, a senior strategist at Standard Chartered, expects higher funding costs to prevail in the offshore yuan market for some time.

“We’ve seen fewer CD issuance in the past few months in Hong Kong and Chinese banks are very likely to switch to the onshore market to raise funds, especially for short-term debt,” Liu said.

A weak currency outlook has dampened investors’ appetite to hold the yuan, as did Chinese property company Kaisa missing a coupon payment, which brought the high-yield dim sum market to a virtual standstill.