Advertisement

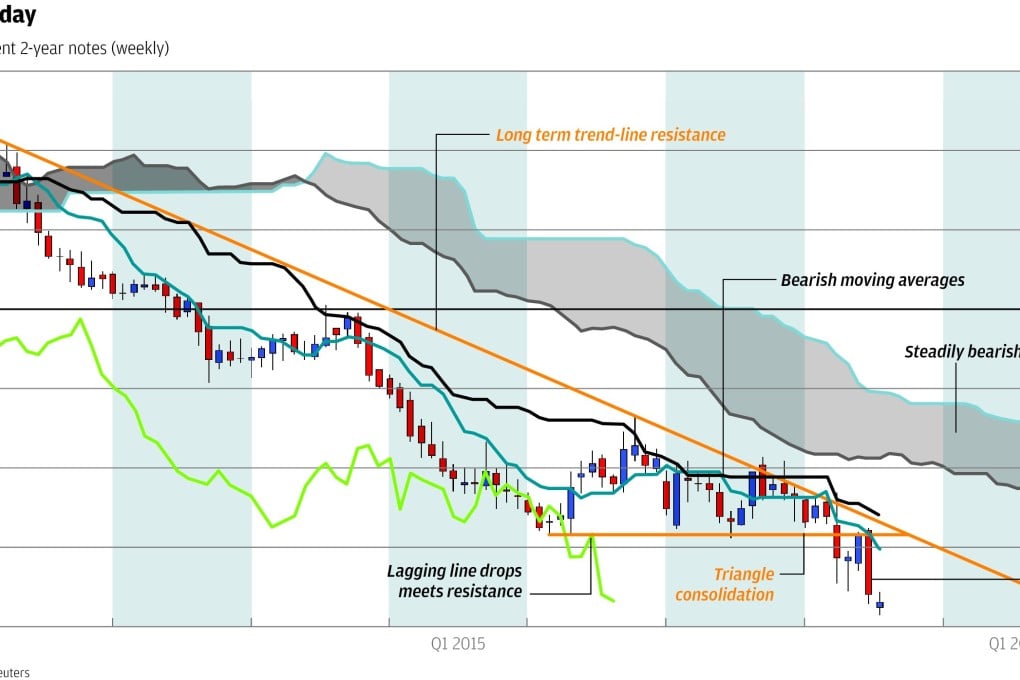

Heavy hints recently as to what rabbit the European Central Bank can still pull out of its hat at December's rate-setting meeting. With the economy weak, inflation well below target for a third year, and unemployment still way too high, something must be done. The fixed-income market is not going to wait and see so they have already pushed German two-year Schatz government debt to a new record low yield at minus 38 basis points. Last week's violent rejection at the lower edge of what had been right-angled triangle consolidation marks an escalation in bearish pressure. Expect a new lower trading band as we move towards minus 50 basis points.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x