China’s insurance regulator tightens licence approvals to cool sector

CIRC tightens licence approval and cracks down on short-term policies to curb financing through insurance platforms

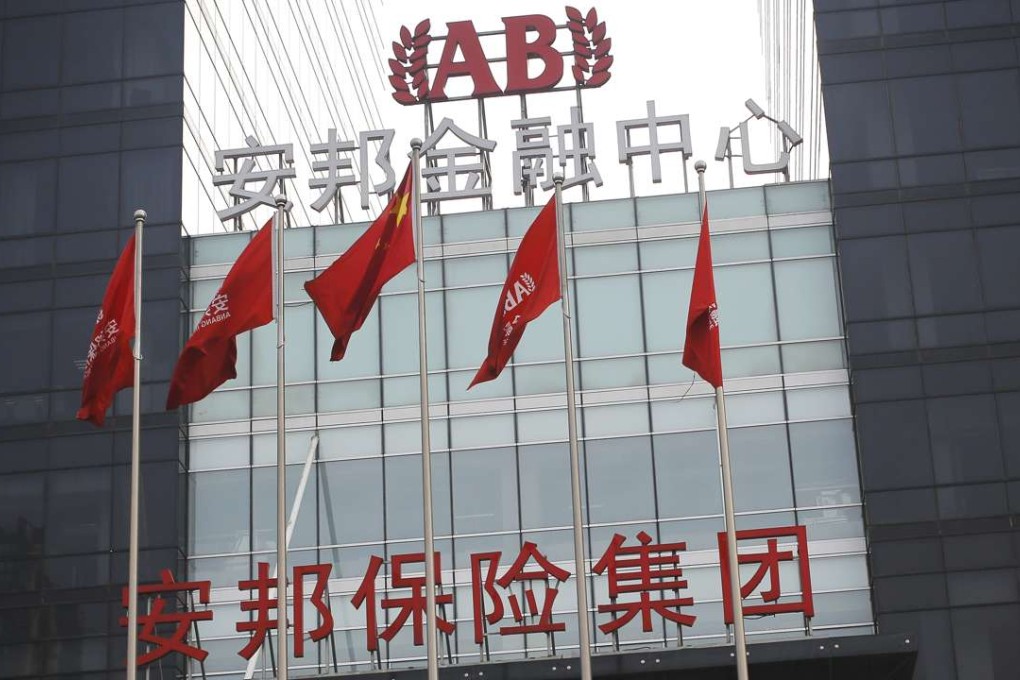

China’s insurance regulator is cooling down the sector by tightening the issuance of business licences and cracking down on short-term products players have relied on in the last few years to support their corporate raids and overseas shopping sprees.

After a shadow-financing-backed stock bull run collapsed and wiped out trillions of dollars of market value in just a few days during summer 2015, the regulators are watching closely for risks brought on by deep-pocketed insurance firms, as their engagement with the A-share market intensifies, triggering concerns for insurance fund safety and market stability.

The China Insurance Regulatory Commission (CIRC) has rejected four licence applications so far this year, already matching the total number of rejections in 2016.

As China’s premiums grow at the fastest pace since 2008, a licence for running an insurance business is becoming the hottest financial resource on China’s capital market.

More than 200 applications are in the queue for verification by the CIRC. In 2016, the regulator approved 20 applications, according to official data.

The cool-down of universal life products will be still the main theme of regulatory focus this year

“The regulator is working from the ‘source of the system’, to strictly shut capital with ‘unpure motives’ out of the industry, by raising the threshold for licence approvals,” Xinhua news agency quoted an unnamed senior CIRC official explaining the latest policy direction on Tuesday.