Chinese funds find sweet spot in city’s insurance sector

Wave of acquisitions in insurance sector began building momentum in 2014, say analysts

Hong Kong insurance companies remain attractive acquisition targets for mainland entities, a trend that has helped to inject fresh capital into the local industry, yet one which also ushers in new regulatory and management challenges, according to industry players.

“The life insurance business in Hong Kong has achieved double-digit growth over the last decade and there is still room for growth in future with the expanding middle class and ageing population,” Peter Tam, chief executive of the Hong Kong Federation of Insurers said in an interview with the South China Morning Post.

“The rule of law and regulation has also bolstered the confidence of mainland buyers to acquire Hong Kong insurance companies in recent years. This trend is going to continue.”

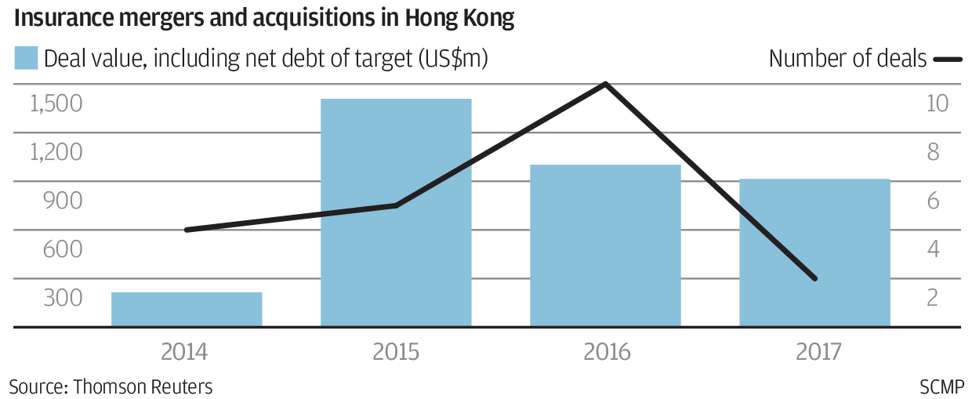

A wave of acquisitions in the insurance sector began building momentum in 2014, resulting in 21 proposed takeovers worth US$4 billion, of which mainland entities are the largest buyers by country of origin, according to Thomson Reuters.

Among the 21 proposed takeovers, nine are led by mainland companies.

On Monday First Origin International said it had reached an agreement to buy shares held by the joint venture of five Hong Kong financial firms, including Asia Financial and Chong Hing Bank, in a deal worth HK$7.1 billion (US$914.8 million).

First Origin is a consortium of five mainland companies sources told the Post. The members include UCF Group, which is based in Beijing and Hong Kong.

“Chinese companies always want to expand overseas, including the financial services industry,” said Joseph Tong Tang, chairman of Morton Securities.

“Buying an existing insurance company will immediately provide the relevant licenses and qualified management staff. It is difficult to form a qualified management team for Chinese insurance companies seeking to establish branches in Hong Kong.”

He added that expectations of a further depreciation of the yuan is another reason cash-rich mainland insurers are seeking to acquire assets in Hong Kong.

“Overseas acquisitions provide a good justification for insurance companies to convert their yuan into Hong Kong dollars,” Tong said.

Francesco Nagari, partner of Deloitte Global IFRS Insurance Leader, said mainland companies are focused on long term business development rather than short term gains.

“They believe in the long term prospects of the Hong Kong insurance industry, which is a well regulated free market,” Nagari said.

Among the major deals, Beijing-based JD Capital, also known as Beijing Tongchuang Jiuding Investment Management, agreed to pay US$1.4 billion in August 2015 to acquire Ageas’s Hong Kong insurance unit. Upon completion last spring, the unit was renamed FTLife Insurance Company.

In a similar deal announced in June, Fujian Thai Hot Investment agreed to pay US$1 billion to buy Dah Sing Financial Holdings’ life insurance business.

These deals however face regulatory and management challenges.

Bernard Chan, president of Asia Financial, said on Thursday at the company’s annual results announcement that it does not expect to book a HK$1 billion profit from the sale of its Hong Kong Life sooner than 2018.

“The Office of the Insurance Commissioner of Hong Kong has been taking a very careful approach to examine any takeover before it grants an approval. The Ageas deal needed almost a year to get approval while the Dah Sing deal is still pending. We do not expect a quick approval,” Chan said.

He said the insurance regulator is seeking information on the purchase price, the business plans of the buyer and other insights to make sure the interests of insurance policy holders are well protected, he said.

Hong Kong regulators also require experienced management be in place to assume the daily operations in order to provide stability during an ownership transfer.

A government source told the Post that the insurance regulator was particularly concerned that the new buyers demonstrate their capability and commitment to the business for the long term.

“The Insurance Authority, being the insurance regulator, has stringent regulatory requirements for any change of shareholding controllers of authorised insurers in Hong Kong,” a spokesman for the Insurance Authority said.

“As an international financial centre, Hong Kong would benefit from having a variety of controlling interests with different backgrounds. This would bring in different know-how, expertise and synergy to the Hong Kong insurance industry.”

Henry Shin, chief executive of Convoy Financial Services, said mainland companies also find value in operating the Hong Kong units as a foreign brand.

“Many mainlanders like to come to Hong Kong to buy Hong Kong insurance policies as they have more investment choice and products. They are in favour of foreign brands,” Shin said.

Mainland consumers have channelled HK$48.9 billion into Hong Kong’s insurance policies, more than double the same period a year earlier. In 2016 up to 37 per cent of all insurance policies sold in Hong Kong were to mainland Chinese policy holders, up from 21.7 per cent in 2015.

“The mainland buying power is likely to benefit the Hong Kong insurers who want to exit from the market,” Shin said.

He added that the capital influx has helped create jobs for sales agents and other professionals in the insurance sector.