China’s banking regulator orders loan checks on Wanda, Fosun, HNA, others

China’s banking regulator has instructed several local banks to conduct financial reviews on selected companies, according to emails seen by the Post

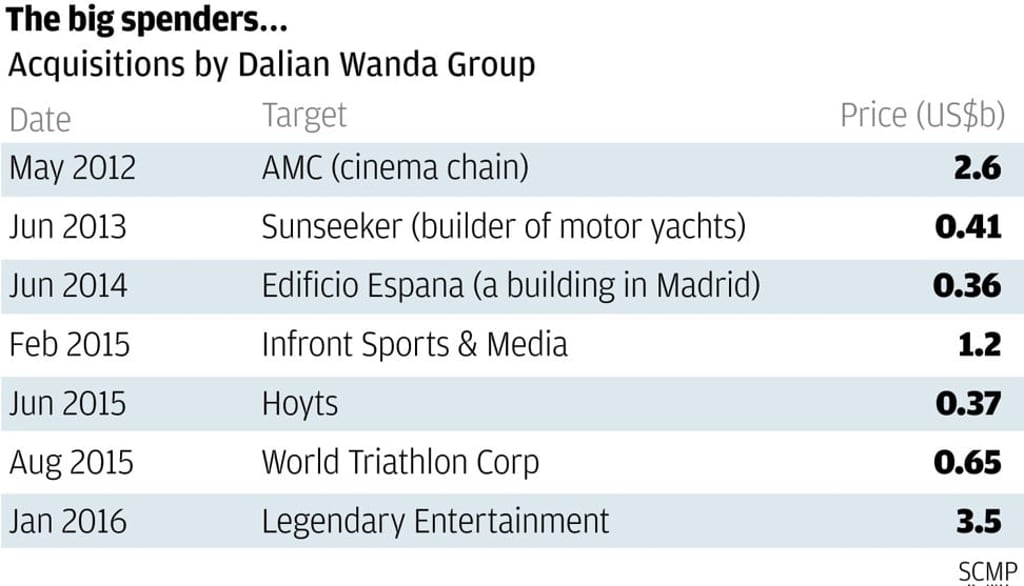

Several of China’s largest overseas asset buyers, including billionaire Wang Jianlin’s Wanda Group, are being placed under scrutiny, amid a government crackdown on money laundering and a grand campaign to check financial risks ahead of the 19th party congress.

Wanda, Fosun, Anbang, HNA and east China’s Zhejiang based Rossoneri Sport Investment -- the vehicle used by Chinese businessman Li Yonghong to acquire Italian soccer club AC Milan in April -- have been singled out for scrutiny by local banks, under a directive by the banking regulator, according to emails seen by the South China Morning Post on Thursday.

The reviews will be conducted by a number of banks, including Industrial & Commercial Bank of China, China Construction Bank, Bank of Communications and China Guangfa Bank, according to the emails.

“Last week we had received regulatory orders to check out our bank’s exposure to the overseas debts carried by the above companies,” a banking source said.

The China Banking Regulatory Commission (CBRC) in mid June required banks to check their credit exposure to the selected companies, and prepare a risk analysis.