QR code takes a baby step in world conquest as group adopts global cashless payment format

A version of the QR code, the ubiquitous data-storage format that dominates daily life in the internet age in mainland China, is taking a significant step abroad, after a global organisation that supports unified payment systems adopted and published the specifications for transactions using the code.

A version of the QR code, the ubiquitous data-storage format that dominates daily life in the internet age in mainland China, is taking a significant step abroad, after a global organisation that supports unified payment systems adopted and published the specifications for transactions using the code.

EMVCo, a consortium for smart payments that’s collectively owned by American Express, Visa, Mastercard and UnionPay, on Saturday published the first version of QR code specifications, or the industry standard for the payment format, a year after UnionPay proposed a safe and open global system.

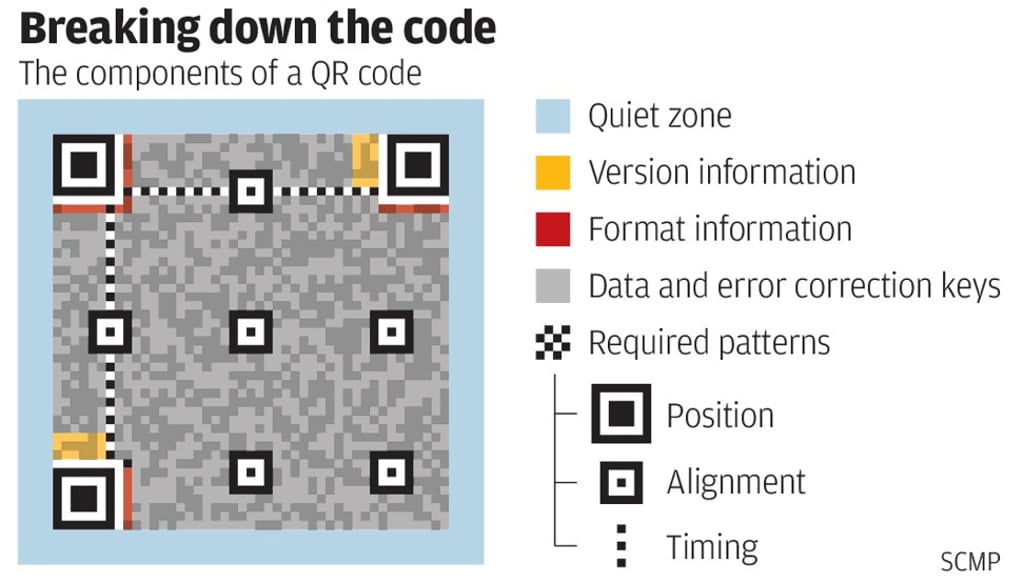

The move is a giant leap in the evolution of the black and white squiggles first created in 1994 by Denso for the Japanese automotive industry. Known as the Quick Response codes, the format comprised random patterns of black squares on white background, capable of holding 300 times more data than traditional bar codes.