PBOC official: China’s asset management sector to shrink

A central bank official says the sector “is likely to” shrink as regulators crack down on irregularities that have contributed to risks in the financial system

China’s asset management sector “is likely to” shrink in scale but would be of improved quality as Chinese regulators step up joint efforts to weed out irregularities, a central bank official told a forum over the weekend in Shanghai.

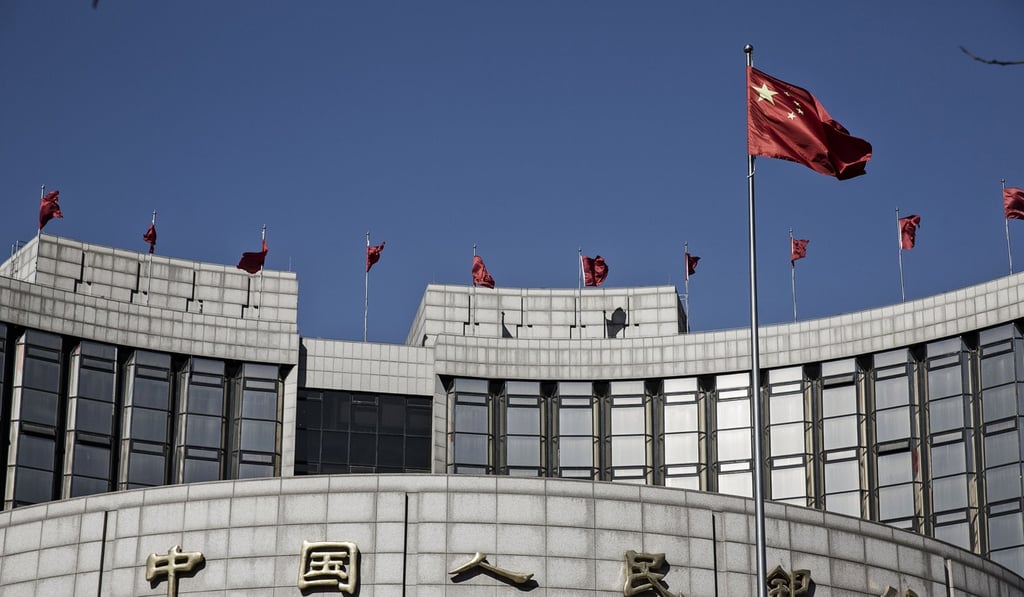

Tao Ling, deputy head of the financial stability bureau at the People’s Bank of China (PBOC), said on Saturday that tighter scrutiny would help squeeze out the bubble, rule out regulatory arbitrage and trim over-leverage, resulting in a possible downsized but better quality sector.

This would help steer capital flow to the real economy, she added.

Tao didn’t indicate the scale of the downsized sector, but provided some details on the six identified irregularities that could lead to cross-sector risks amid increasingly intertwined financial transactions.

The central bank is leading the nation’s banking, securities and insurance regulators in drafting new rules governing the asset management sector.