Opinion | Going green: the changing face of corporate finance

There is a new demand for energy and environmental finance specialists throughout the corporate hierarchy

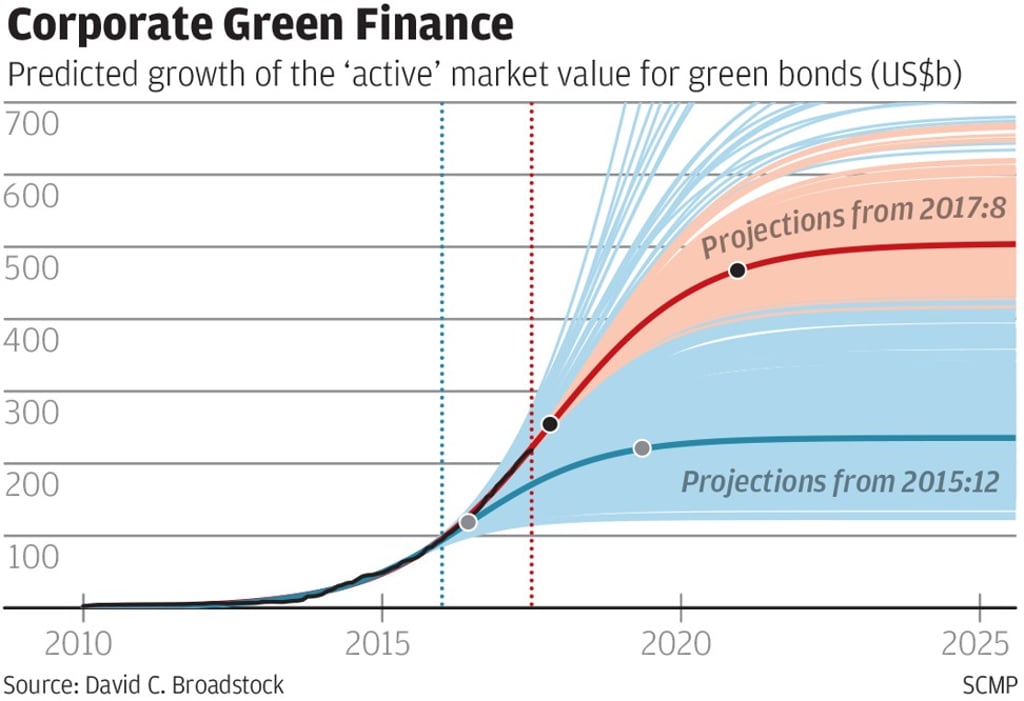

Corporate finance is evolving. Top management teams and senior company executives are under growing pressure to adopt management practices and investment choices that are both socially responsible and financially rewarding. These objectives can sometimes be at odds with each other.

The pressure for firms to be socially responsible is growing at a rapid pace. This is true especially in the Greater China region, which is fast establishing itself as a specialist hub for energy finance. To see this, one might consider two defining milestones of 2017, affecting corporations operating in the region.

Firstly, in November this year, China’s nationwide carbon trading platform will be launched. It is set to become the world’s largest carbon trading market. Immediately, thousands of companies will be confronted with the need to employ carbon trading specialists.

The pressure for firms to be socially responsible is growing at a rapid pace

Secondly, in the early months of 2017, listed companies in Hong Kong started mandatory disclosure of environmental governance indicators including energy consumption and emissions levels.

These features imply that conventional notions of corporate finance and governance need revising. Top management teams require a new corporate vocabulary, and a rank-and-file workforce with new skills.

There is a new demand for energy and environmental finance specialists throughout the corporate hierarchy.

Burnishing a large corporation with a new lexicon and associated skill-set is potentially very costly: re-training/hiring new staff to conduct environmental accounting; creating environmental and social governance reports for stakeholders and the wider public; and possibly putting in place a dedicated team of analysts and traders to develop and implement carbon trading strategies.