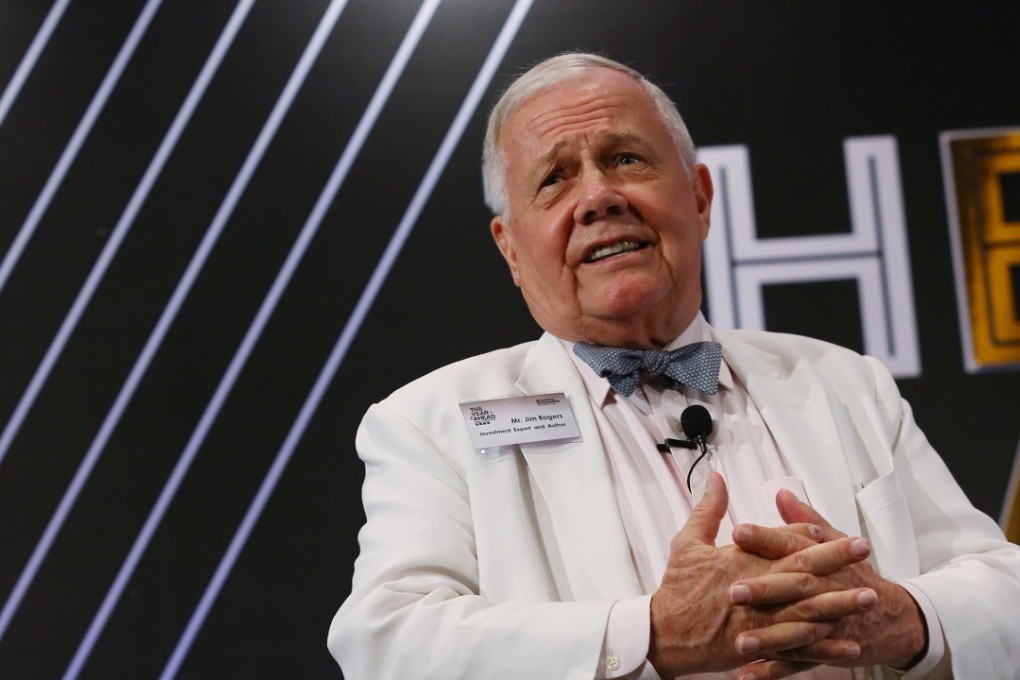

Jim Rogers funded new fintech bank ITF to set up headquarters in Hong Kong

Bank aims to work with city’s fintech companies to develop products and services in a boost to Monetary Authority’s ‘smart banking’ push

ITF, a new fintech bank that veteran US investor Jim Rogers has invested in, will set up its headquarters in Hong Kong and aims to start operating next year, in a move that suggests the Hong Kong Monetary Authority’s efforts to promote technology development in the sector have attracted new comers to the city.

The bank will provide online and mobile banking and financial services and aims to work with fintech companies in the city to develop products and services in banking, wealth management and other financial services.

ITF has been set up by Lim Hui Jie, who was chief executive of the Australia-listed technology company Digimatic Group until March.

“We chose Hong Kong as our headquarters as it is close to the largest market in the world – China,” Lim said at company’s launch in Hong Kong on Wednesday.

“We aim to be an international fintech company and Hong Kong has the regulatory and market conditions to help us achieve our goal as Hong Kong is a very international market. The recent announcement by the Hong Kong Monetary Authority introducing a number of initiatives to promote fintech is very encouraging,” he said.

Lim said ITF would also focus on Singapore to tap the Southeast Asian market, and had applied for licences in Hong Kong and Singapore.