A slow and bumpy ride ahead for China’s economy amid mounting debt and the end of cheap funds

Analysts warn that policymakers who meet for the annual Central Economic Work Conference will have to be cautious with their economic policies

When bank governors of 10 of China’s biggest banks gathered in a hotel in West Shanghai’s Hongkou district on November 30 to protest against draft rules issued by regulators to consolidate the country’s 100 trillion yuan (US$15 trillion) financial services industry under a single regulatory umbrella, they were worried the regulatory tightening, if not carried out gradually, was likely to backfire as interbank liquidity would drain too fast, causing defaults and lead to a chain of failures.

Analysts warn that although bearish sentiment on China had flipped in 2017, with its equities posting respectable gains, currency stabilising, and capital outflow curbed, some of the risks and challenges the country faces in the coming year must not be overlooked.

Overtightening, which will send jitters from money markets to the property sector, is one of the key risks that China has to manage with caution.

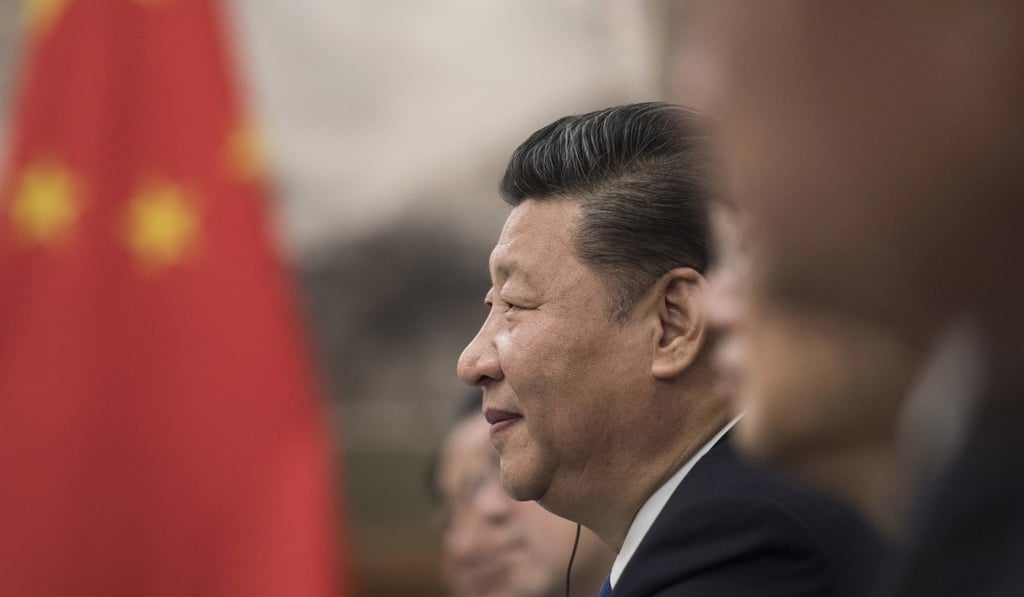

Such risks have been given added urgency, as hundreds of China’s most powerful policymakers gather for the annual Central Economic Work Conference (CEWC) to plot the economic direction and strategies for Chinese President Xi Jinping’s second five-year term.

Obviously, the central government wants to defuse the financial risks fuelled by wild credit expansion in the past years, but they are also aware, and are being told by banks, that haste will backfire

“Obviously, the central government wants to defuse the financial risks fuelled by wild credit expansion in the past years, but they are also aware, and are being told by banks, that haste will backfire. It certainly needs cautious and nimble policies to achieve the goal,” said He Dexu, an economics professor with the Chinese Academy of Social Sciences, China’s top think tank.