Venture capital investment in AI doubled to US$12 billion in 2017

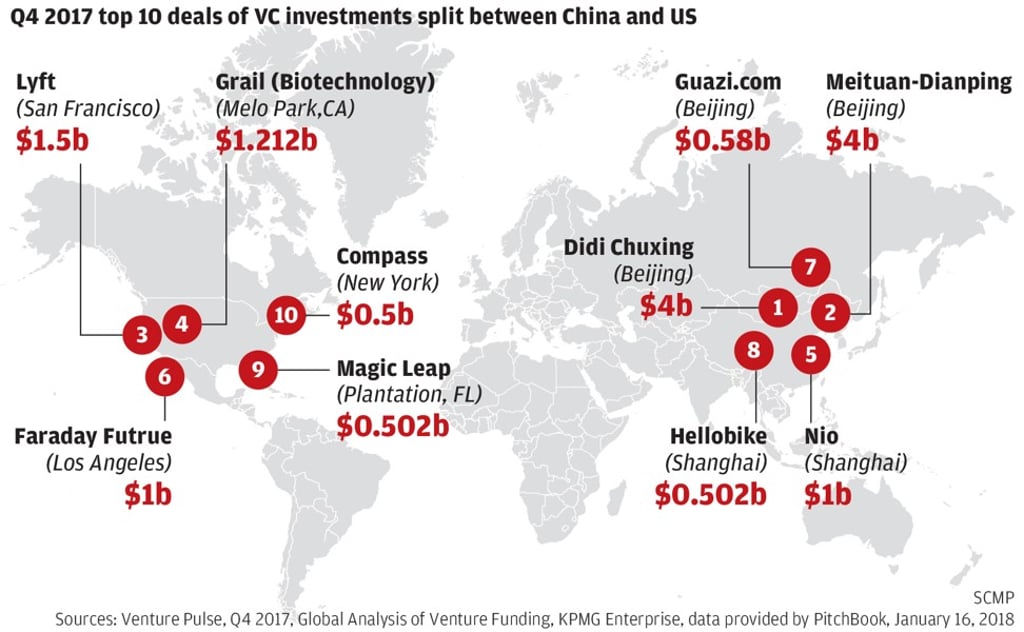

The 10 biggest venture capital deals of Q4 are split evenly between China and the US, KPMG report shows

AI pushed total venture capital (VC) investment in China to a record high of US$40 billion in 2017, up 15 per cent from the previous year.

How AI will change your life this year, from medical advancements to using your face as a credit card

China accounted for five of the world’s 10 biggest venture capital investments in the fourth quarter, the data released on Thursday shows. And more of the companies receiving the financing are electing to plough that money into AI development.

And in early November, Chinese electric vehicle start-up Nio raised more than US$1 billion in its latest fundraising round, also led by Tencent as an existing investor. The company last month launched its first model, the ES8 SUV, with an internal AI-driven personal assistant installed.