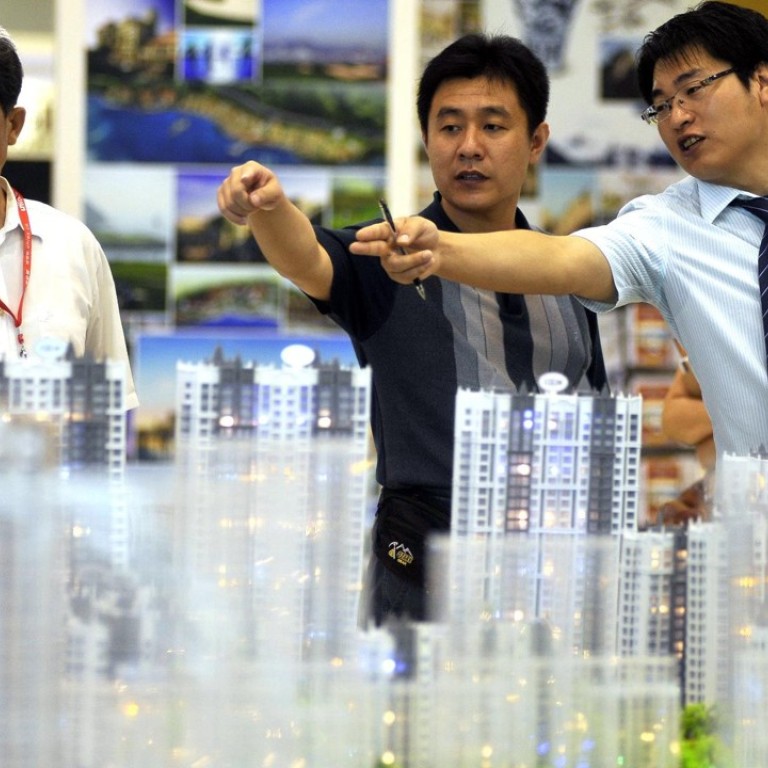

Chinese property firms make a beeline to raise capital in Hong Kong amid mainland freeze

Easy access to Hong Kong’s capital market has provided mainland developers with a lifeline, as their financing had been strictly curbed at home because of the year-long campaign to rein in home prices

Chinese property companies are making a beeline for Hong Kong to raise capital, as one of the world’s best-performing stock markets offers an attractive alternative to the funding squeeze back on the mainland.

A-Living Services, the property management unit of Agile Group Holdings, a developer based in Zhongshan in Guangdong province, will launch an initial public offering on Monday in Hong Kong, aiming to raise between HK$3.6 billion (US$460 million) and HK$4.7 billion.

A-Living plans to use 45 per cent of the proceeds to acquire rivals and will invest the rest mainly in industry investment funds and firms providing complementary services, besides building a “one-stop service platform”.

“We will provide more value-added services, [use] advanced technologies to improve customers’ experience and enhance cost efficiency,” Huang Fengchao, co-chairman of A-Living, told reporters on Sunday.

“We will also expand our property management services portfolio and enhance competitiveness by selectively pursuing strategic investment, acquisition and alliance opportunities.”

The company ranked 22nd among the top 100 property management firms in China with a 0.3 per cent market share by gross floor area managed in 2016, according to its listing prospectus, which cited China Index Academy figures.

A-Living managed 76.3 million square metres in 65 cities at the end of September last year.

It acquired in June last year the property management unit of its parent’s rival, Shanghai-based developer Greenland Holdings, which became a 20 per cent shareholder of A-Living.

Chief executive Liu Deming said Greenland Property Services will focus on the high-rise buildings such as offices and hotels, shopping malls and industrial parks, while Agile Property Management will mainly cover residential buildings and vacation properties.

A-Living estimated its net profit to have grown 75 per cent to 281.3 million yuan (US$44.4 million) last year from 2016, with earnings per share last year of HK$0.26.

The indicative IPO price range represents 41.5 to 54.6 times 2017 estimated earnings per share.

CIFI Holdings, another mainland developer, said it would issue its first HK$2.79 billion zero-coupon convertible bonds.

The conversion price will be HK$9.30 per share, a 30 per cent conversion premium to the latest closing price, and CIFI said the sale “has received overwhelming response from investors and recorded a substantial oversubscription and was priced at high-end price”.

The two financing deals follow the 22 per cent rally in the Hang Seng Mainland Properties Index so far this year, outpacing the 10.7 per cent gain in the benchmark index. Easy access to Hong Kong’s capital market has provided Chinese developers with a lifeline, as their financing has been strictly curbed on the mainland due to the year-long campaign to rein in home prices. No property company has been allowed to raise capital through IPOs or bond sales on the mainland since 2017.

CIFI’s share price has surged 51 per cent while Agile’s stock has risen 21.9 per cent.

“The market is quite optimistic about Chinese property firms listing in Hong Kong, because of the solid earnings growth last year and the good dividend payout,” said Michael Chen, head of equity investment at SinoPAC Holdings. “These big-cap property stocks follow a similar logic of the bank stocks.”

Agile’s share price multiple over its estimated 2017 earnings per share stood at 9.99 on Friday, compared to CIFI’s 10.96. Agile’s earnings were estimated to have grown over 20 cent last year from 2016.

Big-cap developers have generally given a continuing earnings growth projection for 2018 in their guidance to investors, and the expected market share advancing, due to industry consolidation, has given cause for optimism, said CIMB’s property analyst Raymond Cheng.

“It is a departure from a few years ago, when the capital market was consistently bearish on Chinese property stocks,” he said, adding a few stocks such as Sunac China Holdings and Country Garden Holdings may have become too expensive.

Mainland China’s property tightening policies may not escalate, as current home prices are stable, a reason for investors to be bullish, said Philip Tse, a property analyst with Bocom.