Hong Kong’s monetary authority raises lending rate to 2 per cent to defend peg, raise mortgages

After an increase in US interest rates, the Hong Kong Monetary Authority moves to maintain the HK dollar’s tie to US currency.

The Hong Kong Monetary Authority on Thursday morning raised the city’s base lending rate, in lockstep with a similar increase by the US Federal Reserve to defend the local currency’s peg and add upwards pressure to mortgage payments linked to interbank rates.

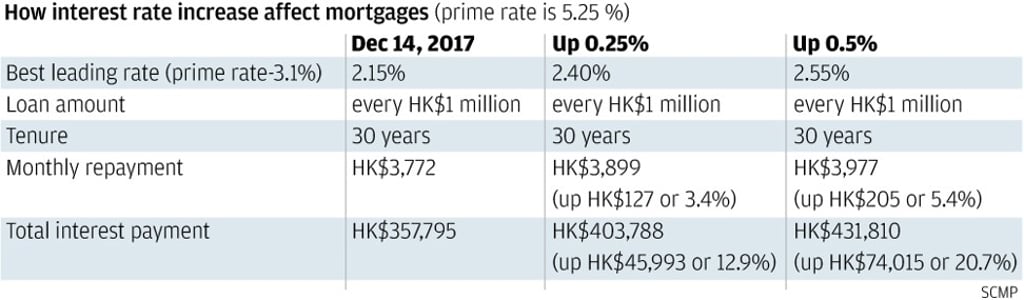

The base lending rate rose by 25 basis points to 2 per cent, matching an increase of the same quantum by the US central bank. Mortgage payments linked to the Hong Kong Interbank Offered Rates, or Hibor, would increase. One-month Hibor rose to 0.81 per cent on Thursday while the three-month Hibor rose to 1.11 per cent.

“The latest rate increase is going to add burden to many Hong Kong mortgage borrowers who link their monthly payments to the Hibor, which moves in line with the HKMA’s official rates,” said Gordon Tsui Luen-on, managing director of Hantec Pacific. “The six rounds of US rate increases since December 2015 have boosted the Hibor-linked mortgage loans by 50 basis points to over 2 per cent, compared with six months ago.”

The much-anticipated move by the HKMA did little to slow the Hong Kong dollar’s deterioration to its weakest level in 35 years. The local currency changed hands at 7.8457 per US dollar yesterday, near the lower limit of a decade-old trading band of between 7.75 and 7.85 per US dollar.

“The Hong Kong dollar is now on the edge of the weak end of the peg,” said the HKMA’s chief executive Norman Chan Tak-lam, at a press briefing during which he affirmed the authority’s commitment to defend the Hong Kong dollar’s peg to the greenback. “Once the threshold is touched, HKMA will defend the peg by buying the Hong Kong dollar and selling the US dollar.”