One in seven in Hong Kong is a millionaire as property and stock market rallies boost wealth

Real estate accounts for 70pc of millionaires’ assets, with each owning 3.2 properties on average, according to a Citibank survey

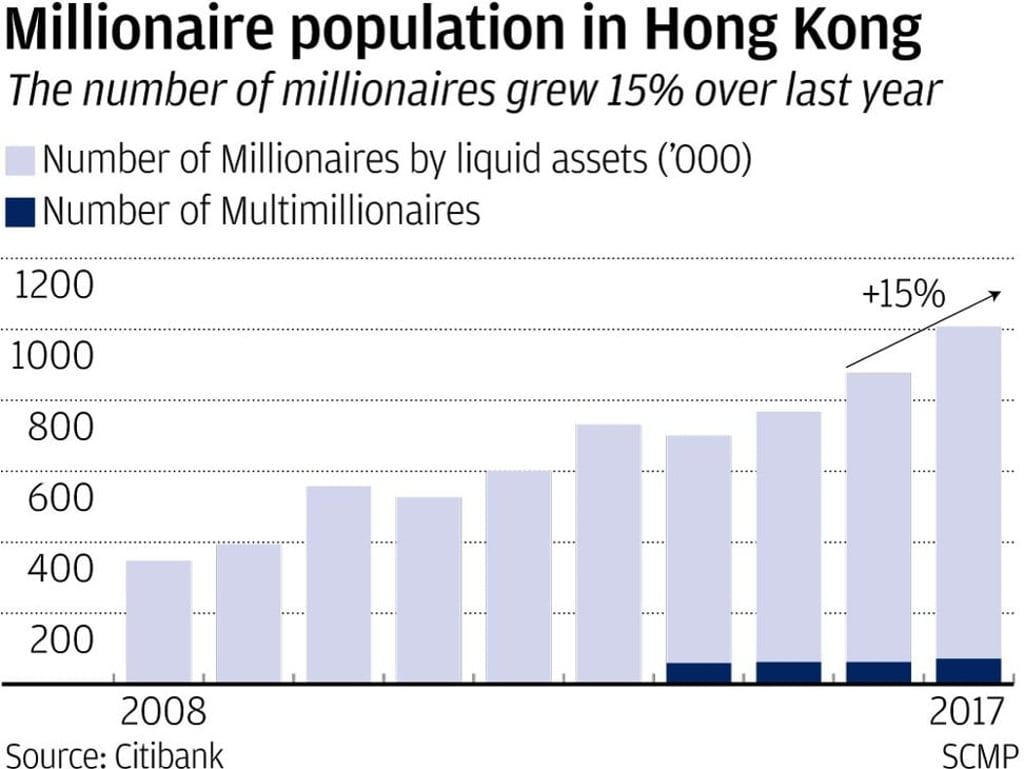

Hong Kong had a million millionaires last year, up 15 per cent from a year earlier, 68,000 of whom have at least HK$10 million (US$1.27 million), according to a Citibank study released on Thursday.

The study defines millionaires as those with liquid assets – deposits, mutual funds and stocks and bonds – of HK$1 million. It was conducted from September to November last year and involved 4,139 Hongkongers and 200 mainlanders.

Hong Kong’s population in 2017 was 7.36 million.

The growth in the number of millionaires was a result of the rising stock and property markets last year. The Hang Seng Index rose 36 per cent in 2017 while property prices rose 14 per cent, creating more wealthy men and women in Hong Kong.