HSBC strikes back in mobile payment war, lifts PayMe monthly top-up limit to HK$50K

HSBC plans to increase the top-up limit of its e-payment app PayMe by 10 times to HK$50,000 (US$6,370) as early as this week, at it prepares to expand the app’s purchase utility among merchants this year, the bank said on Tuesday.

The biggest bank in Hong Kong will also allow customers to transfer money from their personal bank account with HSBC to their PayMe e-wallet, broadening a service that was previously only available by credit card top-up.

Customers from later this week will be able to transfer to their PayMe e-wallet from their HSBC personal bank account up to HK$30,000 per month, or HK$50,000 if they can provide a Hong Kong residential address. The current limit is HK$5,000 from any credit card per month.

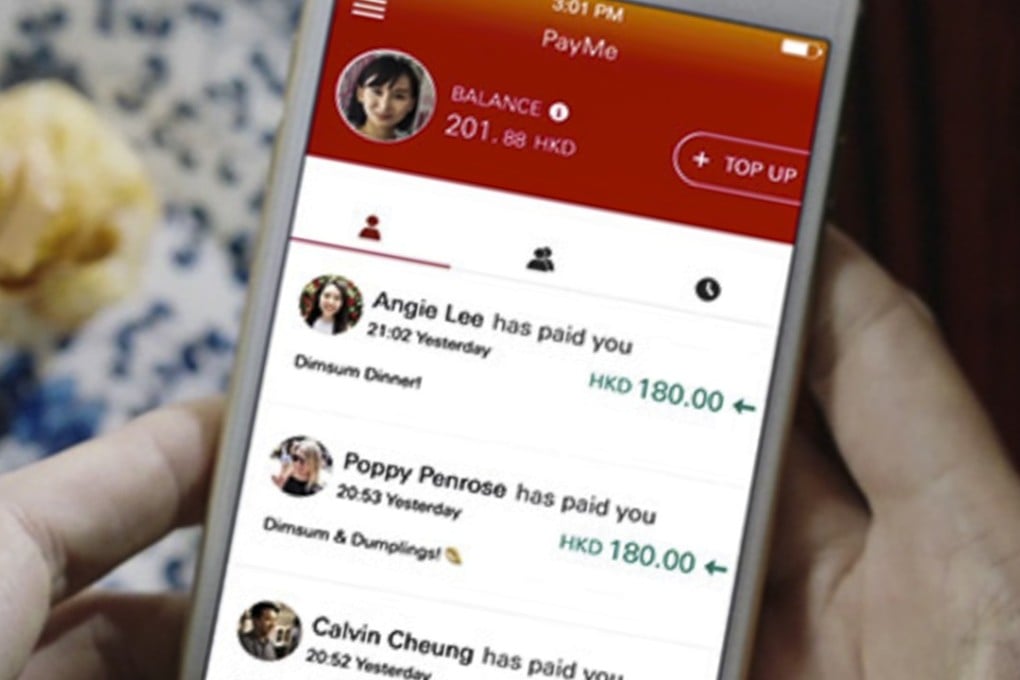

Launched early last year, PayMe is used mainly by customers to transfer small amounts of money to settle restaurant bills among friends or offer laisee.

The change means PayMe will compete directly with other mobile payment operators such as Octopus, Alipay, WeChat Pay or Apple Pay, which are frequently used to make purchases at supermarkets, shops or restaurants as well as paying taxi fares.

Andrew Eldon, head of digital of retail banking and wealth management of Hong Kong at HSBC, said the bank will announce “in the not distant future” plans to allow PayMe to be used for purchase at merchants. The system is likely to involve QR code technology, which is a common method for merchants to accept payment by mobile phone.