China’s plan to cut debt, ensure efficient capital may be mission impossible in a slower economy

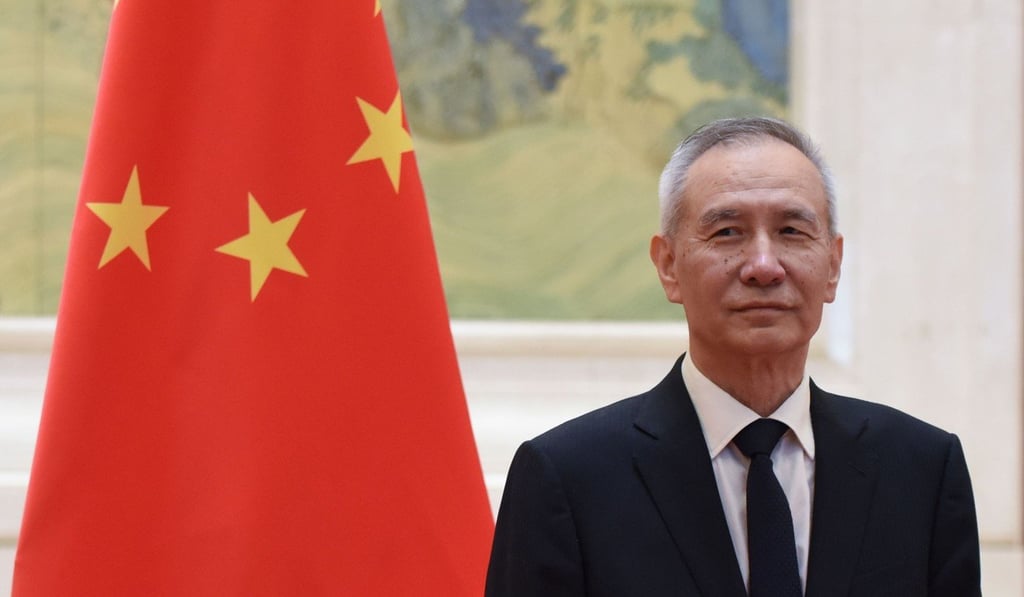

Liu He’s appointment to head task force bodes well for China’s attempt to reform the nation’s state-owned enterprises

China must improve the efficiency in the way capital is allocated across the economy, according to a recommendation by the International Monetary Fund (IMF). The success of that plan will depend on the government’s ability to cut debt and reform the country’s state-owned enterprises.

Credit growth has “slowed significantly” in China since 2017 as China’s top-down deleveraging campaign has crippled shadow bank lending and curbed traditional borrowing, the IMF said in its Article IV review of the Chinese economy released last week.

Under the IMF staff’s baseline case, China’s credit intensity ratio (the amount of credit necessary to generate each incremental amount of economic growth) is expected to improve from 3.1 in 2017 to 2.6 in 2023.

“That improvement, however, will not be enough to stabilise the credit-to-GDP ratio,” the IMF report warned.

China can finally stabilise the ratio of total debt to the size of the economy by the year of 2020, and see it fall thereafter, if it can significantly improve credit efficiency by increasing the allocation of credit to the nation’s most profitable corporations.