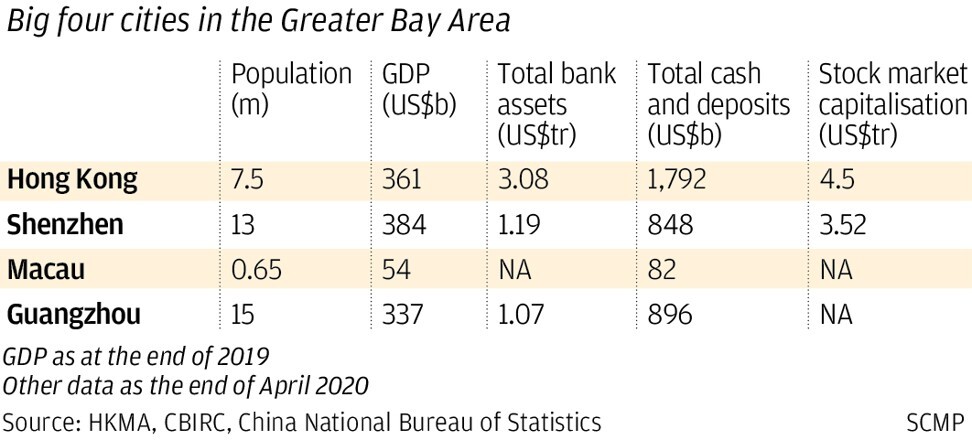

Explainer | How China’s Greater Bay Area wealth management connect could help millionaires move their money across borders

- Size of quota, launch date as well as decisions on movement of people and capital still need to be fleshed out, say industry practitioners

- Cross-border banking partnerships seen as key to implementation

Under the pilot scheme, dubbed Wealth Management Connect, Hong Kong and Macau residents can buy onshore wealth management products sold by Chinese banks, while bay area residents can invest in products sold by Hong Kong and Macau’s banks.

Behind the scenes, regulators and industry professionals are fleshing out the details and have come up with a working plan for marketing products, regulation of mis-selling, and the type of products allowed, the South China Morning Post has learned.

Hong Kong will attract listings by international companies, not just Chinese firms, as Greater Bay Area opens up

“To make this real, the economic impact for Hong Kong and the bay area needs to be greater than from the Mutual Recognition of Funds scheme,” said Ricardo Wenzel, a wealth and asset management adviser at KPMG.

Wealth Management Connect, which was first proposed two years ago, still lacks a launch date, list of products and investment quota size.

“We’re still waiting for a lot of the details,” said Tai Hui, JP Morgan Asset Management’s chief strategist for Asia. “What I hope to see is a tighter geographical coverage [than the nationwide MRF], but hopefully a broader product range.”

02:35

China's ambitious plan to develop it own ‘Greater Bay Area’

A sticking point is how banks engage clients. Most banks cannot sell to a client for the first time without meeting them face-to-face and going through a host of protocols such as anti-money-laundering checks.

The scheme’s architects have come up with a neat solution. There will be a one-to-one partnership between banks on either side of the border, according to three people involved in the planning.

The whole process of marketing to the client will be handled by the bank on the same side of the border as the client, obviating the need for bankers or clients to cross borders. Everyone will have to find their dance partner, quipped one industry professional.

If this one-to-one structure is formally adopted, how to punish mis-selling would also fall into place.

If a client makes a complaint, the regulator on the same side of the border as the banker responsible for misrepresenting the product or selling it to an unqualified investor deals with it. If the product itself is flawed, then that would fall under the jurisdiction of the regulator that manages the bank that manufactured the product, said the people.

Another hurdle is China’s capital controls, limiting the amount of money flowing in and out of the country.

Wealth Management Connect will be a “closed loop” said the announcement. This means it will follow the same rule as the Stock and Bond Connect schemes: if investors buy a product in Hong Kong and then sell it, the proceeds must flow back into the mainland.

It is likely to have a more flexible quota system than the old MRF that had a combined North and South quota of 600 billion yuan (US$86 billion) and limited asset managers from selling more in mainland China than they had under management in Hong Kong.

Five years after its launch, the China Securities Regulatory Commission had only approved 29 funds, often with delays of 18 months to three years. Mainlanders had dropped just 17.2 billion yuan net into the scheme as at the end of May this year, according to China’s State Administration of Foreign Exchange (Safe), or 5.7 per cent of the southbound quota.

Hong Kong’s Securities and Futures Commission (SFC) has approved 50 mainland funds under the MRF in the same period. However, Hongkongers spent only 328 million yuan net on these mainland funds as of the end of May, according to Safe, only 0.1 per cent of the northbound quota.

“Wealth Management Connect will not be a repeat of the Mutual Recognition of Funds as it will work in a completely different way,” said Christine Lin, a partner at consultancy firm EY, who contributed to the first draft of the plan back in 2018.

The door to China’s wealth market creaks open to the Bay Area

It is also unclear as yet which wealth management products will be allowed under the scheme.

But unlike the MRF scheme, Lin said regulators would not require financial institutions to seek approval for individual funds or products. Instead, the SFC and the CSRC will give “blanket approval” for batches.

Most industry professionals expect the watchdogs will initially only allow the least risky and most easily understood products into the scheme. That rules out racy products such as accumulators, derivatives or structured instruments.

So not all of the over 2,000 funds with assets under management of over US$1.7 trillion authorised by the SFC, will make it into the scheme.

“It is likely to be those so-called ‘plain vanilla’ funds to begin with,” said Bruno Lee, chairman of Hong Kong Investment Funds Association.

Likewise, the SFC is unlikely to allow retail investors in Hong Kong to buy the full gamut of mainland China’s wealth management products.

This caution is partly because wealth management means very different things on the mainland and in international circles. Bank wealth management products in China mushroomed as shadow banking grew in the mainland, said Peter Alexander, founder and managing director of Z-Ben Advisors, a fund consultancy in Shanghai.

Those investment products are “bank savings substitutes” that provide short duration options over three months, six months or nine months, with returns typically of 4 or 5 per cent. “I have no clue how this [Wealth Management Connect] is going to work,” he said.

00:58

Hongkongers dreaming of big gains from Greater Bay Area homes could be disappointed

Market participants expect a repeat performance of how other cross-border investment channels with mainland China have evolved since 2014. Beijing tends to point the direction, followed by a lot of discussions and not much real business before, eventually, traffic swells.

It took seven months between the announcement of Stock Connect and its launch, but longer than that for regulators on both sides of the border to iron out the kinks in the trading scheme such as settlement and around two years before turnover started to build.

Swiss bank UBS expects China to launch the scheme before the end of this year. Others are more sceptical.

“I certainly think this will take longer than some might expect,” Alexander said.

Additional reporting by Chad Bray