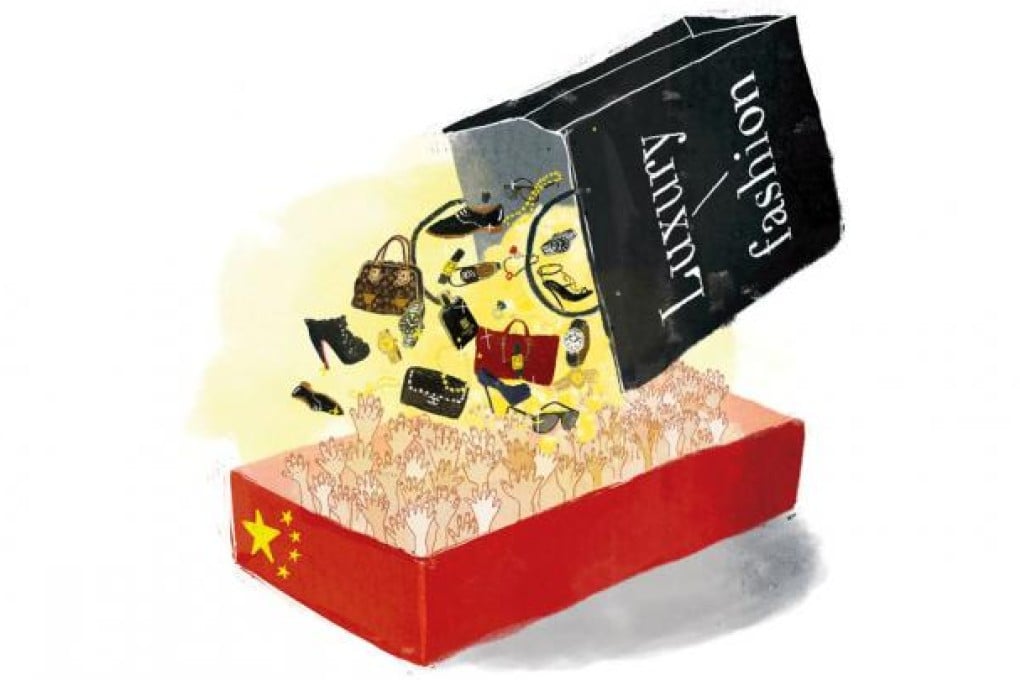

How China is changing finer things in life

The mainland's relationship with fashion and luxury may have been affected by the global slowdown, but the party's not over yet

The rising importance of China in luxury and fashion has taken a new twist. While a recent Bain & Co report found that China is the fastest-growing luxury market in the world, and the Boston Consulting Group showed that China is jockeying to become the largest luxury and fashion market by 2015, recent economic forecasts underscore a slowing Chinese economy. Some luxury brands such as London-based Burberry already have been hard hit by the slowdown and have revised their earnings guidance downward.

First, Chinese customers generally have moved from mere followers to burgeoning global tastemakers in less than a decade.

This can be seen in two arenas of global consumption: Chinese customers are, on average, much younger than their Western counterparts; and the customer base. While the average European and American customer of luxury goods is typically aged 40 to 45, in China, customers are often in their 20s or 30s. And, while luxury consumption in the West has been dominated by women - especially in segments such as fashion, leather goods, and jewellery - this is not the case in China, where men lead the way beyond traditional male-dominated segments such as watches.

Both younger customers and men are two major potential growth segments for an industry that is considered "mature" in Europe and the United States.

Chinese customers could lead the way in a global evolution of the luxury industry, as well as be an inspiration for maturing markets.

Second, Chinese investors recently have shown their savoir-faire in acquiring Western fashion "sleeping beauties", and reviving them. This is the case of French fashion house Lanvin, acquired in 2001 by Taiwanese-based Shaw-Lan Wang. Wang hired Alber Elbaz as creative director for the house, and turned it into the most creative fashion firm in the world, according to the renowned Journal du Textile bi-annual ranking. Similarly, Hong Kong-based Fung Brands acquired 80 per cent of Paris-based Sonia Rykiel earlier this year, and helped the brand survive difficult economic times and secure future growth drivers, although industry analysts agree it is too early to call the operation a success.