China corporate debt dumped as rates surge, lifting firms' borrowing costs

As banks protect themselves after interbank rates jump, Chinese companies are paying more for loans - prompting many to defer bond sales

China's decision to tolerate the worst cash crunch on record is evolving from a stress test of banks into a threat to the ability of companies to raise funds.

As their overnight borrowing costs neared 13 per cent, banks switched focus towards shoring up their own finances and slashed investments in the bond market they dominate. The one-year yield on AAA corporate debt jumped a record 121 basis points, or 1.21 per cent, this month to 5.15 per cent, ChinaBond indices show. Bond sales slumped to 157.9 billion yuan (HK$200 billion) in June, the least in 17 months and down 57 per cent from May.

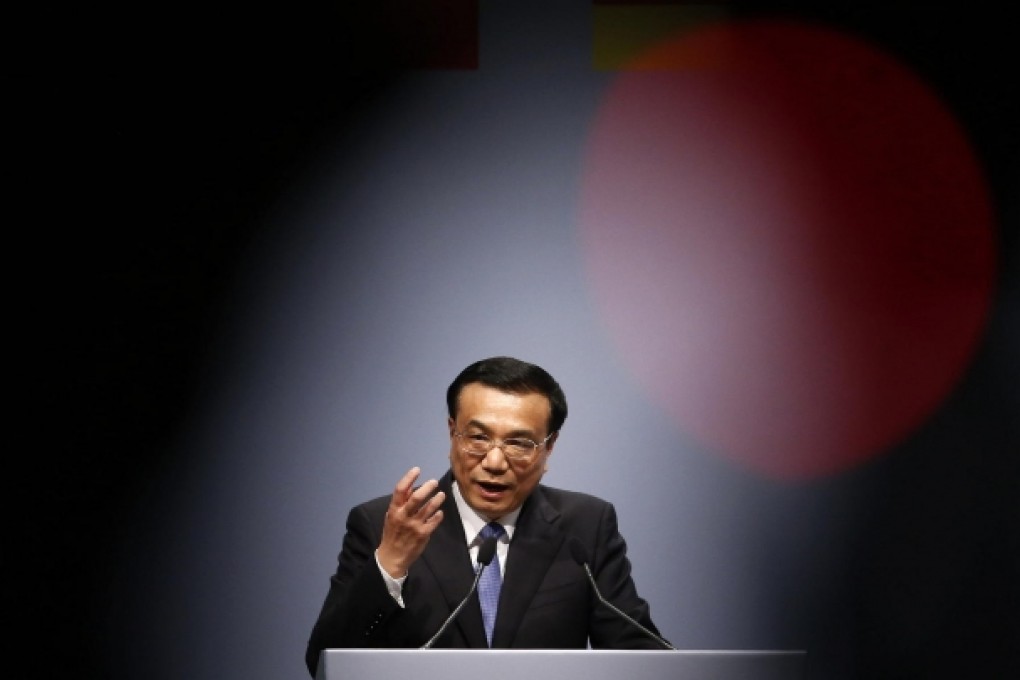

China's cabinet, led by Premier Li Keqiang, said following a June 19 meeting that finance companies must do more to support economic transformation and reduce risks, after administrative measures to crack down on property and local government investment failed to halt the accumulation of debt. The timing of the credit squeeze has puzzled economists since official data shows a worsening contraction in manufacturing, easing inflation and a slowdown in foreign investment inflows.

"The current level of tightness in real market rates is excessive and, if continued, may disrupt growth rather than make it more balanced," said Dariusz Kowalczyk, a strategist in Hong Kong at Credit Agricole CIB. "Balancing growth would be achieved easier by boosting consumption, not by restricting credit. I think they will ease monetary settings soon, via open-market operations or reserve-requirement ratio cuts."

The central bank has refrained from adding funds to the financial system and sold two billion yuan of notes on Thursday to drain capital, even as money market rates hit a record high. The World Bank, HSBC, Morgan Stanley and UBS cut 2013 gross domestic product estimates for China this month.

Yuan forwards fell the most in five weeks on Thursday after Federal Reserve chairman Ben Bernanke said the central bank may reduce monetary stimulus that helped spur fund inflows to emerging-market assets. More than US$19 billion has left funds investing in developing-nation assets in the three weeks to June 12, the most since 2011, according to US research firm EPFR Global. Foreign direct investment in China rose in May by the least in four months.