Monitor | No sign of an end to China markets' woeful performance

Chinese shares may indeed look cheap, but predictions of a rally in mainland stocks are merely a triumph of hope over experience

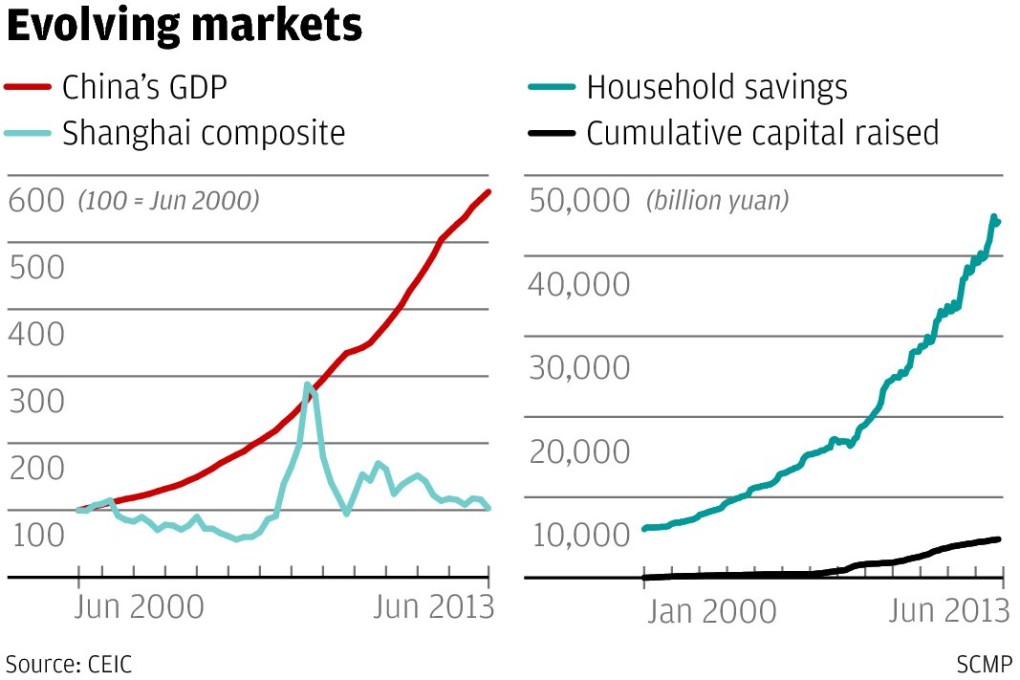

When China's stock markets fell to a four-year low last week, it triggered a spurt of reports from optimistic analysts claiming the mainland's benchmark stock indices had finally found a bottom and were poised to rebound.

Some of these pointed out that on a valuation of just nine times expected earnings for this year, mainland markets now look spectacularly cheap.

Others pored over the charts to detect "technical" signals that mainland stocks were overdue for a rally.

Now, to be fair, mainland stocks are indeed cheap compared to other major markets. And technical analysis isn't all voodoo. Market movements just reflect human behaviour, and there are patterns in price charts, just as there are patterns in the movement of crowds.

Even so, predictions of a sustained rally in mainland stock markets represent a heady triumph of hope over experience.