No timetable for key reforms in Shanghai zone

Lack of deadline for plans such as yuan policies raises questions over pace of the moves

The mainland has specified no deadline for key economic reforms in its new free-trade zone including unrestricted currency flows, a government document shows, raising questions over the pace of the moves.

The lack of a firm schedule for some crucial commitments in the Shanghai zone indicates reforms will be step-by-step instead of a "Big Bang", and raises the possibility that they could be delayed, potentially for years, unless the government decides to push them forward.

Analysts and business executives say the high expectations created by mainland authorities and state media around the inauguration of the zone in September have yet to be fulfilled.

"Everyone feels the degree of opening [of the zone] is not enough," Shanghai mayor Yang Xiong admitted over the weekend.

The launch of the free-trade zone came ahead of an important Communist Party meeting from November 9-12, which will focus on economic reform, mainland officials and academics say.

Free conversion of the yuan, greater cross-border use of the currency and interest rate liberalisation would be "promoted" following establishment of the zone, the government document said.

The document added that Shanghai would "actively strive for relevant state departments to advance a clear route and timetable" for the reforms.

In contrast, the detailed paper showed other moves in the free-trade zone had a set timetable. For example, the securities regulator would by the first half of next year revise a rule to allow overseas companies to trade commodities futures.

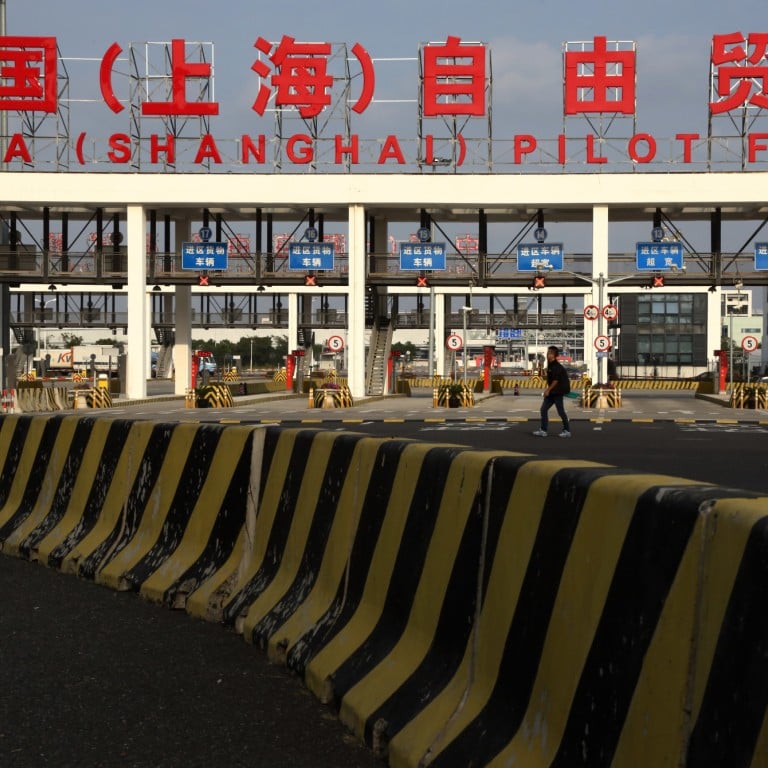

The mainland formally set up the free-trade zone in Shanghai on September 29. Ahead of the launch, the State Council, or cabinet, had pledged sweeping financial reforms in the zone.

Convertibility of the yuan - allowing the currency to be freely bought and sold, and with it the movement of funds into and out of the country - is the main obstacle preventing Shanghai from competing with global financial centres such as New York and London.

The government keeps a tight grip on the capital account - investment and financial transactions, rather than those related to trade - on worries that unpredictable inflows or outflows could harm the economy and reduce its control over it.

Nonetheless, Yang, speaking at a rare news conference, declined to give a schedule for financial reforms in the free-trade zone.

"For specific measures, we will discuss them … and await the proper moment to introduce them step by step," he said.

Yang acknowledged that a so-called "negative list" of restrictions "may still have many aspects that everyone feels are not too satisfactory" and that another version could be issued next year.

The list, originally hailed by mainland media as a breakthrough in looser control, includes nearly 200 restrictions across 18 sectors.

"The negative list was longer than expected," said mainland-based commentator Bill Bishop. "There hasn't been what we've been hoping for in the financial industry. But it's a little too early to write it off."