Fosun pays HK$12.7b for three Portuguese insurance firms

Fosun International, a Hong Kong-listed investment company, has beaten a US firm to acquire three Portuguese state-owned insurers for €1.21 billion (HK$12.76 billion).

Fosun International, a Hong Kong-listed investment company, has beaten a US firm to acquire three Portuguese state-owned insurers for €1.21 billion (HK$12.76 billion).

Fosun said yesterday it had submitted successful bids for 80 per cent of Fidelidade-Companhia de Seguros, Multicare-Seguros de Saude and Cares-Companhia de Seguros.

The three insurance firms were previously wholly owned by Portuguese state-owned bank Caixa Geral de Depositos (CGD), which said the price totalled €1.21 billion.

The deals were part of the Portuguese government's privatisation of CGD to enable the bank to focus on financial intermediation, it said.

The privatisation was required under the bailout agreement the debt-laden country reached with the European Union and International Monetary Fund.

In 2012, the Portuguese government sold 21.35 per cent of Energias de Portugal to China Three Gorges Corp for €2.69 billion, making the Chinese state-owned enterprise the largest shareholder of the utility firm.

Apollo Global Management, a US investment firm, lost out to Fosun in the bidding for the three insurers. Apollo and Fosun were the two bidders shortlisted by the Portuguese government, Reuters reported.

"[Fosun] had previously announced its intention to acquire the insurance firms of CGD. Fosun's prospects are bullish," Kingston Securities said in a report. "The company continually increases the scale of its business."

Fosun bought Chase Manhattan Plaza, a 60-storey New York tower, from JP Morgan in October last year for US$725 million.

"The insurance business will be one of our core businesses in future," Fosun said in its interim report last year.

Insurance is a small but fast-growing part of Fosun's portfolio. In 2012, the sector represented only 4.8 per cent of its assets but its value has soared 1,182 per cent to 7.79 billion yuan (HK$9.98 billion).

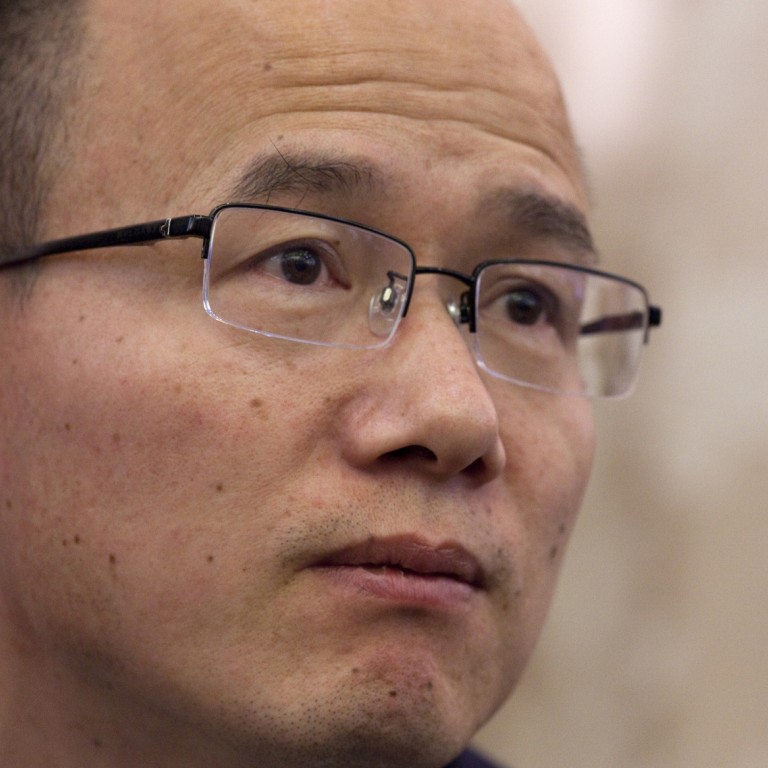

Fosun's major shareholder is its chairman, Guo Guangchang, a former vice-president of the Shanghai Federation of Industry and Commerce. In November, Fosun issued a statement denying the authorities had prevented Guo from leaving the country.