Ratings bias accusations flow both East and West

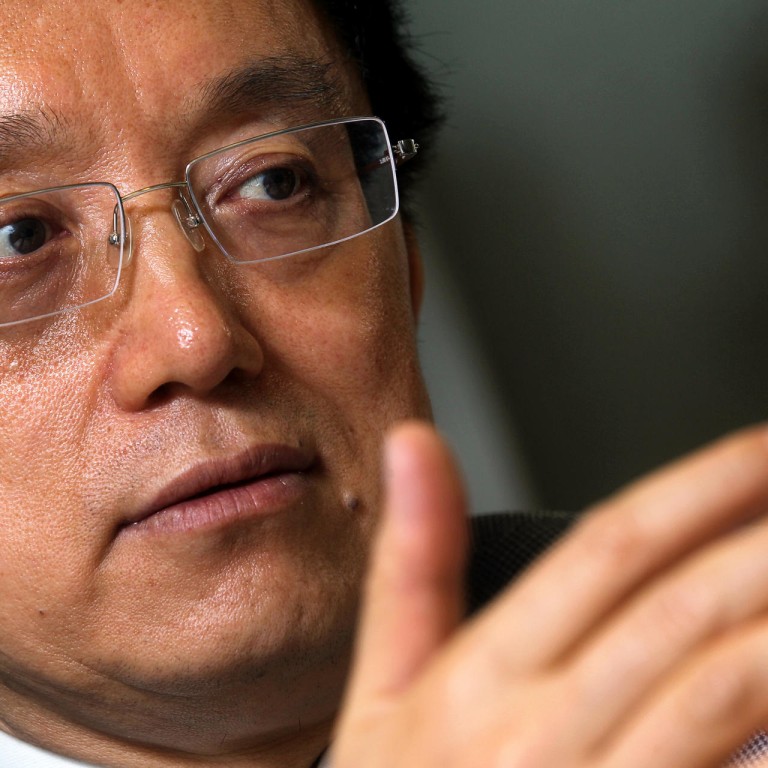

Guan Jianzhong, Dagong's Beijing-based chairman, criticises the big three international rating agencies - Moody's, Standard & Poor's and Fitch - for serving a pro-United States agenda.

Guan Jianzhong, Dagong's Beijing-based chairman, criticises the big three international rating agencies - Moody's, Standard & Poor's and Fitch - for serving a pro-United States agenda.

"Because of the connectivity and economic and political influence of the US as a superpower, the agencies have become used to a way of thinking," said Guan.

"If we look at their method, their way of thinking reflects they are in favour of the strong power and hegemony [of the US]."

He cites as an example the big three agencies' rule of capping all corporate issuers' rating at no higher than the sovereign rating. Many emerging-market issuers have complained this sovereign cap unfairly and arbitrarily raises their cost of capital, without penalising firms in developed nations.

Guan takes issue in particular with the United States' triple-A rating. The big three agencies, he says, give consideration to criteria such as gross domestic product per capita, which he says has no bearing on a nation's creditworthiness.

"The solvency of the central government is not linked to the GDP per capita," said Guan.

While Guan acknowledges that S&P did downgrade the US below triple A in 2011, he said key people were subsequently pushed out as punishment. The big three also consider a country's political system when applying a sovereign rating, favouring the liberal democracies of the West, which disadvantages emerging markets.

It was with some relish then that Dagong downgraded the US sovereign rating, in 2010 and again in 2011. The agency currently assigns a higher sovereign rating to China than all the Group of Seven nations.

Dagong applied to the US Securities and Futures Commission in 2009 for status as a Nationally Recognised Statistical Rating Organisation (NSRO). This would have made the agency's ratings relevant to most international investors, but the SEC rejected Dagong's application in 2010.

Six weeks later Dagong downgraded the US sovereign rating.

"Dagong published their downgrade not too long after being rejected for an NSRO … you can't get away from the perception that Dagong felt they were unfairly rejected," said Michael Nocera, who advised the firm on its application.

Dagong launched in June 2013 an alternative to the big three with its Universal Credit Rating Group, in partnership with the US-based Egan-Jones Ratings and Russia's RusRating. Former French prime minister Dominique de Villepin is chairman of the firm's advisory board. The agency is conceived as a counterpoint to the influence and methods of the big three.

But as much as Dagong takes the big three to task for its Western biases, Dagong is unabashedly pro-China.

The firms says on its website that, "Dagong takes the rise of credit rating industry as an important part of the great rejuvenation of Chinese nation and bravely shoulders the challenging historic mission".

Guan sums up Dagong's role thus: "To represent the national interests of China."