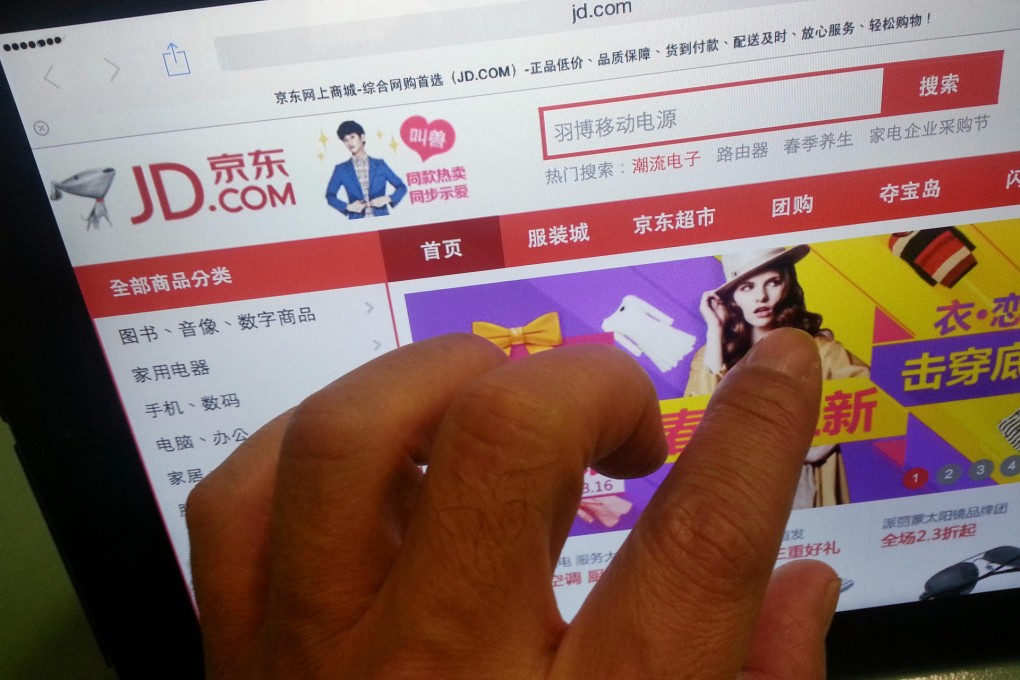

Tencent-JD.com alliance intensifies e-commerce challenge to Alibaba

Partnership may reshape China's e-commerce market as more people shop using smartphones

Shenzhen-based Tencent, through subsidiary Huang River Investment, also committed to subscribe to an additional 5 per cent of JD, following the Beijing-based firm's planned initial public offering in the United States.

"By acquiring a stake in the mainland's second-largest business-to-consumer platform, Tencent can more effectively compete against Alibaba in the e-commerce sector," said Ricky Lai, a research analyst at Guotai Junan International.

Data from internet consultancy iResearch showed that JD had a 17.5 per cent share of the business-to-consumer e-commerce market in the third quarter of last year, while the online retail operations under third-ranked Tencent E-commerce had a combined 6 per cent share.

In a statement, Tencent president Martin Lau Chi-ping said: "Our strategic partnership with JD will not only extend our presence in the fast-growing physical-goods e-commerce market, but also allow us to better develop our enabling services such as payments, public accounts and performance-based advertising network."