To deal with the expected impact of Beijing's austerity drive, China Southern Airlines - the mainland's biggest airline by fleet size - will adjust its cabin structure to expand the premier-economy class while reducing the ratio of first-class seats, company chairman Si Xianmin said yesterday.

"This new regulation will affect the performance of our first and business class," Si told China Southern's annual results briefing. "So we need to follow the market demands to optimise our cabin structure, and advance our premier-economy class."

China Southern flew 91.8 million passengers last year, with 2.52 million taking first or business class, up 14.5 per cent year on year. The load factor for the top two classes increased 2.9 percentage points to 44.8 per cent.

To try to maintain the increase, chief operating officer Zhang Zifang said China Southern would soon introduce products targeting its frequent flyers to encourage them to fly in elite cabins.

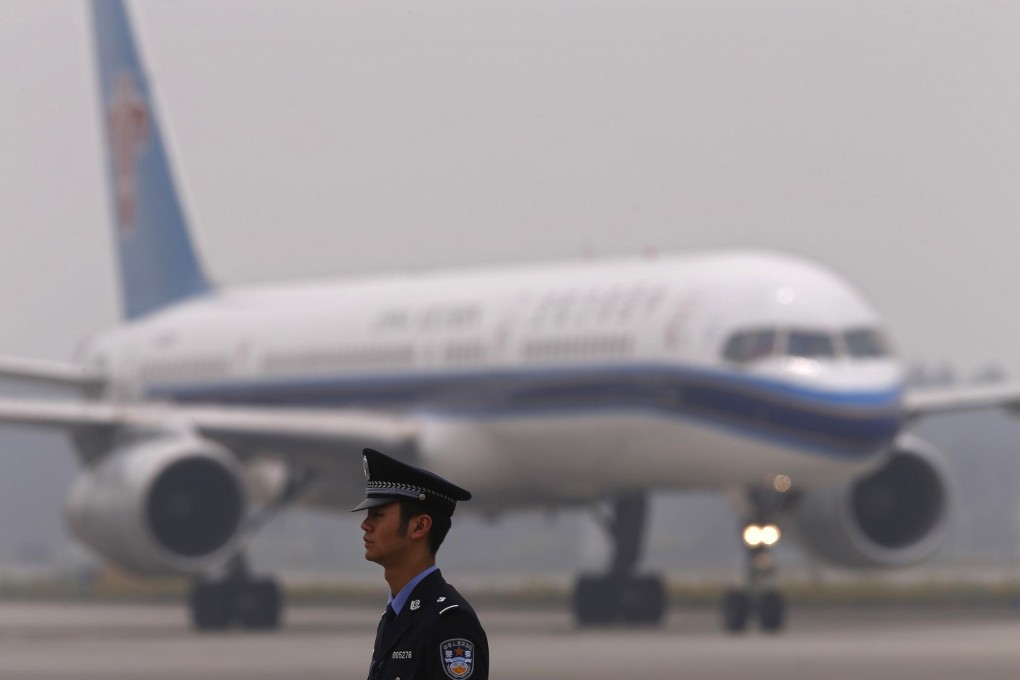

The austerity drive has also posed threats to its rivals, Air China and China Eastern Airlines. Air China said it would focus on independent high-end tourists while China Eastern said it would eye the low-cost carrier market to make up for the loss in premier cabins.