Advertisement

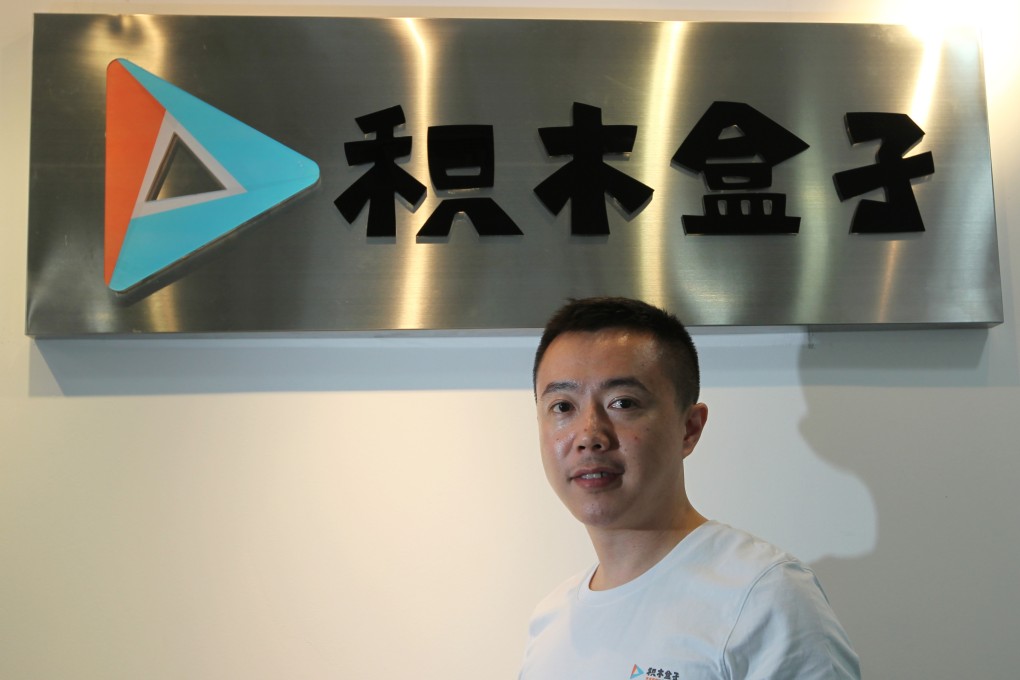

Online lending start-up Jimubox sees hopes in industry shake-up

After a series of industry scandals, the founder of peer-to-peer lending platform Jimubox is confident reforms will see the sector come of age

Reading Time:3 minutes

Why you can trust SCMP

The founder of online lending start-up Jimubox.com says he sees the brighter side of an industry shake-up sparked by tighter regulation following a spate of scandals at similar platforms.

"Although we are an online platform, every project needs to go through a due diligence process that is more or less the same as the practice of traditional financial institutions," Dong said.

Advertisement

Borrowers were required to have sufficient income to repay loans, he said, and Jimubox had built a due diligence team to do on-site investigations and data research to reduce default risks.

Every project [on Jimubox.com] needs to go through a due diligence process

Financing projects are listed on the company's website, offering details about the borrower, use of funds, repayment plan and annualised returns.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x