New | China's services sector attracts strong foreign investment flows

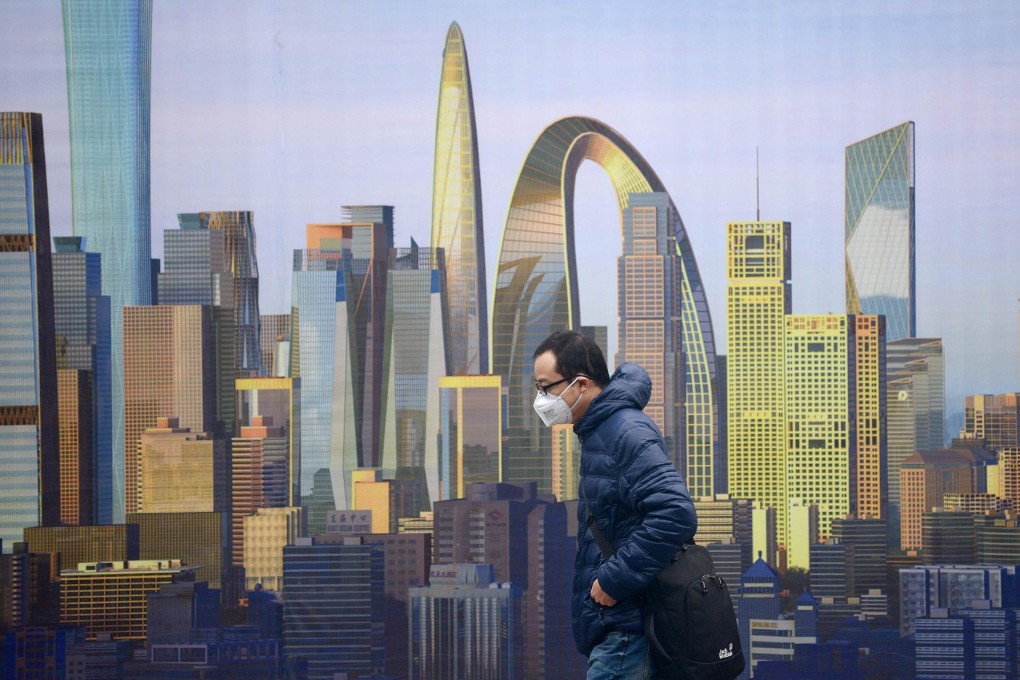

Foreign investment shift reflects China's economic rebalancing away from a reliance on investment-led growth and exports

Scratch below the downbeat figures for investment flows into China and there are some nuggets that will hearten policymakers in the face of talk of the diminishing appeal of the country in the eyes of international investors.

Foreign direct investment grew just 1.7 per cent to US$119.56 billion last year, the slowest rate of expansion in two years, Ministry of Commerce data shows. It is a far cry from the 23.6 per cent growth notched in 2008.

However, the services sector drew inflows of US$66.2 billion, up 7.8 per cent from the previous year. The surge lifted the sector to 55.4 per cent of total investment into the mainland, professional services firm KPMG said.

The result should buoy the Beijing leadership in its efforts to achieve a rebalancing of the economy towards services as part of a shift away from fixed-asset investment. Increased investment in inland provinces also proved a bright spot and may help soften perceptions that foreign firms face discrimination after some high-profile firms fell foul of mainland regulators over the past year.

Overseas investment in the manufacturing sector - long the driving force of China's economic miracle - fell 12.3 per cent to US$39.9 billion and accounted for 33.4 per cent of total inflows, KPMG said.

"The growth of service sector FDI reflects an underlying shift in China's economy," it said. "For much of the past 30 years, China's economic policies tended to emphasise investment activities and export-led manufacturing over domestic consumption.