Money Matters | Fosun boss disappears despite saying all the right things

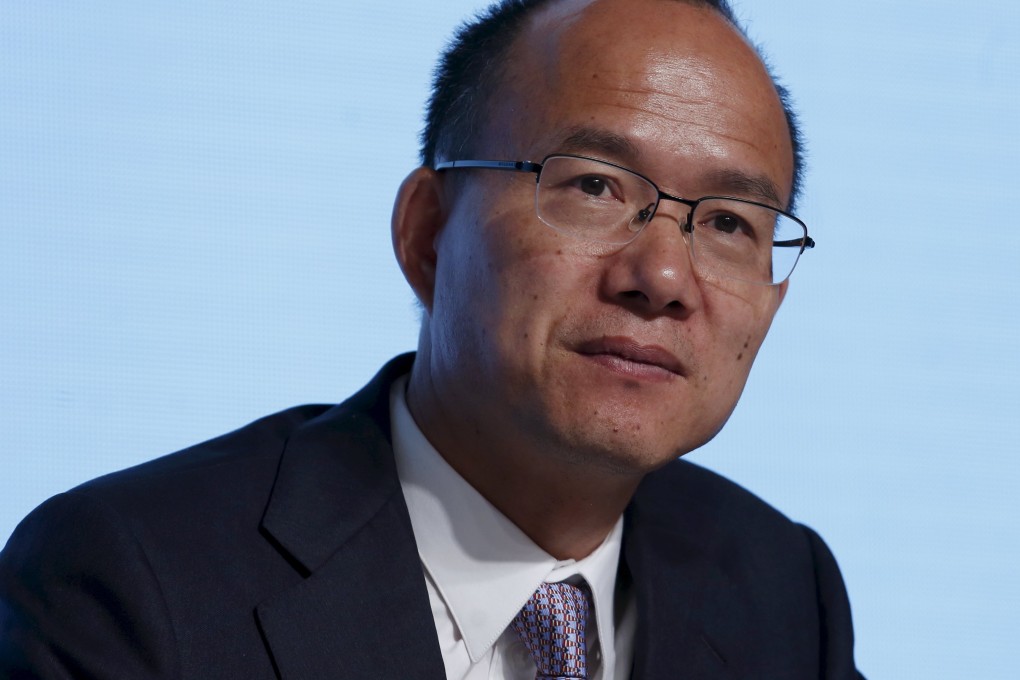

Guo Guangchang has been doing everything possible to walk the fine line in a country where every private entrepreneur survives at the mercy of the Party.

The "Godfather of Shanghai Business World" has been amazingly successful in keeping a low profile despite being ranked the fourth-wealthiest man in China. The last time he made a public appearance, he was spouting his allegiance to the Party.

Last year, he penned an article for a local magazine that said: "People asked why I am not worried. You have to believe that as long as you have made no mistake, the government will not mess with you. Many don't think so. They say however good you are, the government can easily finish you off.

"My answer to that is if I have been good, why would the government want to target me? This is not in line with either the reform policy or the Party value.

"I believe in the future of China. I believe in the Party's reform policy. The four founders (of his Fosun empire) hold no foreign passports. We are PRC citizens.

"We have full confidence in our motherland. This is easily said. Yet, how many private entrepreneurs truly believe in it? I don't see many."