Shanghai FTZ’s third anniversary nothing to celebrate given slow progress on financial reform

Hopes for liberalising the capital account were hobbled by fears over loss of control, says expert

The Shanghai Free Trade Zone has failed to live up to the lofty expectations that came with its launch three years ago, with the disappointing progress shedding light on the difficulties of managing the world’s second-largest economy.

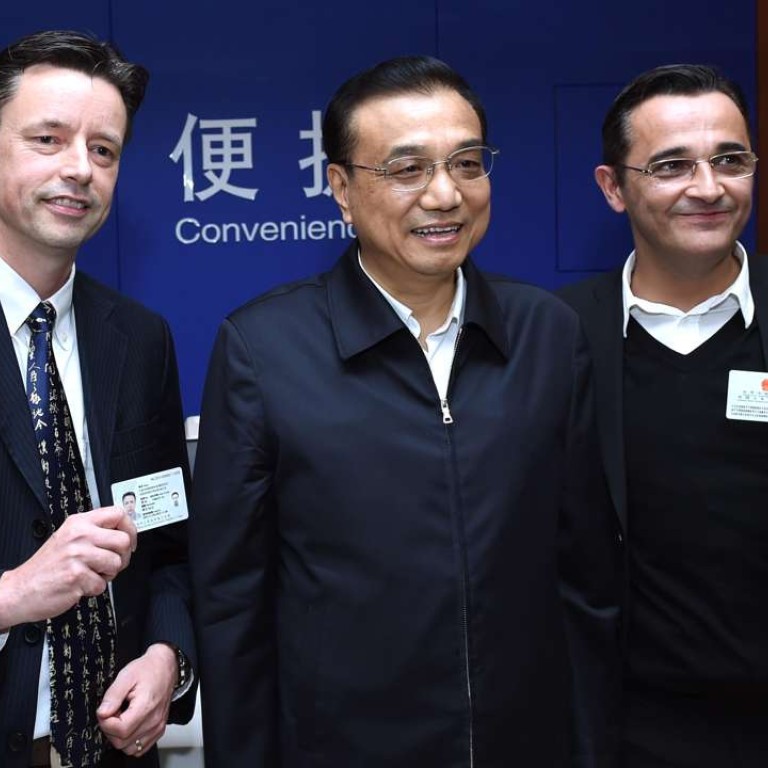

Thursday marks the third anniversary of what was once a pet project for Premier Li Keqiang, a project that fuelled hopes for liberalising the nation’s capital account, but any anniversary celebrations are likely to be low-key.

The central government’s sluggish pace towards freedom of capital movement has largely been due to fear of losing control of capital flows, said Zhao Xijun, a professor of finance with Renmin University. He added that the outlook for any bolder moves looked bleak.

In 2014 Zhao was a member of a team from the university that was invited by the National Development and Reform Commission to assess progress of the Shanghai FTZ.

“The fear of losing hold of capital movement was behind the caution,” Zhao said in an interview with the South China Morning Post.

When the Shanghai Free Trade Zone was set up in 2013 it raised eyebrows because of its plan to introduce a pilot scheme to gradually remove capital controls as a step towards a freely convertible yuan.

At the time, the pace of the yuan’s internationalisation had gathered speed, with currency swap agreements with the Bank of England and European Central Bank and the boosting of offshore yuan use in the Hong Kong market. In 2013 the yuan ranked as the world’s eighth most transacted currency, up from 18th position in 2010, according to data from the Bank of International Settlement.

But it was also a time when signs of fragility in China’s economy and financial system began to surface, reverberating across markets as exports lost steam and an unprecedented credit crunch sent the benchmark annualised overnight repo rate soaring to a record high of 30 per cent. Investor nerves were also frayed after a “fat-finger error” in a bond transaction by Everbright Securities triggered years of court trials and industry reflection.

“If we lift restrictions on capital flow in the free trade zone, it equates to a complete loosening in the country, which would lead to unregulated capital movement and a big challenge for regulators to manage risks,” Zhao said.

After a surge of capital outflows late last year caused by large bets on a depreciating yuan, regulators tightened controls, a move directly in contrast with the express purpose of the Shanghai FTZ.

The disappointing progress has also silenced calls for the zone to potentially participate in the US-led Trans-Pacific Partnership, a proposed high-level trade and investment pact for countries in the Pacific Rim, though China is not currently part of the pact.

“If financial capital could flow freely between the FTZ and other economies, and if there was full mobility between the FTZ and the rest of China, the FTZ would become a gateway for unfettered financial capital flow in and out of China’s broader economy,” said Louis Kuijs, a Hong Kong-based economist with Oxford Economics.

“That’s not what the central government would want to see since it would heavily compromise its nationwide policy regime. That is why such financial flows between the FTZ and the rest of China were only allowed on a small scale – up to a quota,” he said.

The current extent of opening of the capital account and exchange rate regime is appropriate for China’s economy

Regulators saw some relief as outflows eased this year after last summer’s stock meltdown triggered a surge of capital outflows. But regulator’s have also slowed the pace of the yuan’s internationalisation since it won a confidence vote last November to become the fifth currency in the basket of Special Drawing Rights of the International Monetary Fund.

Zhao said he doesn’t think there will be rapid or major progress in the further opening up of financial markets.Strong central bank intervention to defend the yuan and speculative capital outflows have jointly reinforced a cautious attitude by the authority on managing the capital account, he said.

“The current extent of opening of the capital account and exchange rate regime is appropriate for China’s economy,” he said. “It is already the maximum that China’s economy and macro-economic control can bear.”

Instead, China could expand the use of the SDR to reduce the world’s reliance on the US dollar, rather than betting on bolder moves to liberalise the yuan and capital account in the short term, Zhao said.

Kuijs added, “I think where many people went wrong was in having unrealistic expectations as to how quickly China’s central government would liberalise its nationwide policies on financial capital flows and how tolerant it would be with initiatives compromising nationwide policies.”