Director buying surges in HK, while selling declines

HSBC, Greatview Aseptic Packaging, AIA Group, Jacobson Pharma and Langham Hospitality dominate buybacks

The buying by directors rose for the second straight week based on filings on the exchange from February 20 to 24 with seven companies that recorded 25 purchases worth HK$46.5 million. The figures were up from the previous week’s six firms, 23 purchases and HK$30 million. The selling, on the other hand, fell with a paltry three companies with 11 disposals worth HK$2.1 million. The number of disposals was up from the previous week’s nine trades but the number of firms and value were sharply down from the previous week’s six companies and HK$124 million.

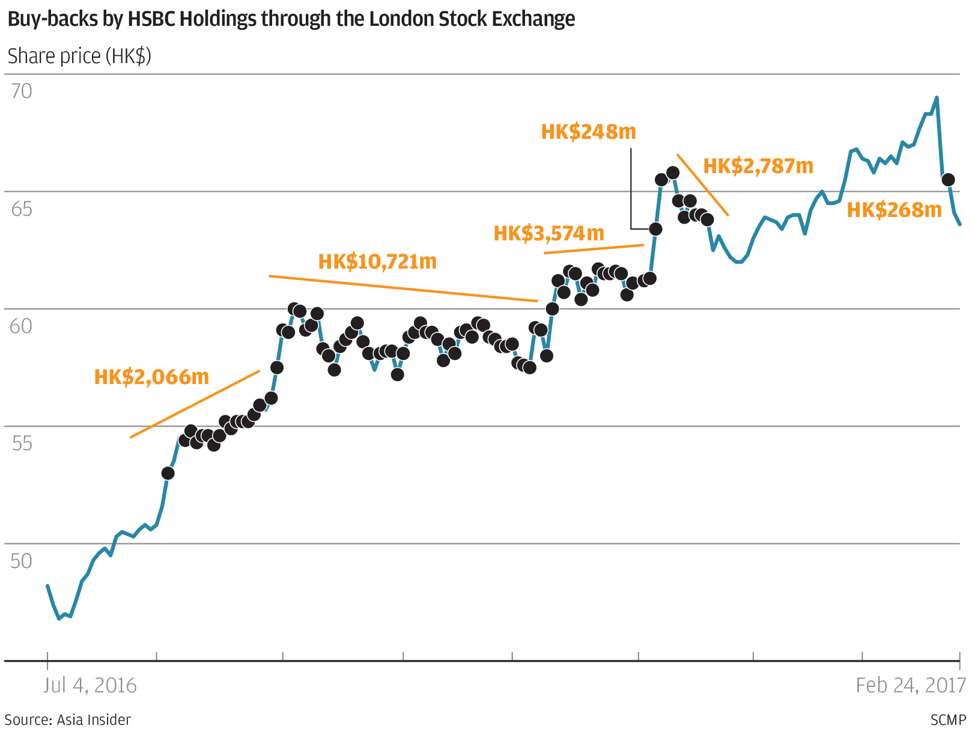

While the buying by directors rose last week, the buyback activity surged with eight companies that posted 36 repurchases worth HK$367 million based on filings from Monday to Thursday. The figures were up from the previous week’s five-day totals of seven firms, 28 trades and HK$74 million. The large turnover was mainly due to repurchases by HSBC Holdings with buybacks worth HK$268 million.

Blue chip global banking giant HSBC Holdings embarked on its second buyback programme with 4.1 million shares purchased (via the London Stock Exchange) on February 22 at HK$65.22 each. The trade was made on the back of the 5 per cent rebound in the share price since the last week of December 2016 from HK$61.95. The buyback was also made after the group announced on February 21 a 77 per cent drop in year-end profit to US$3.446 billion. This recent buyback is part of the group’s plan to cancel up to US$1 billion (HK$7.8 billion) worth of shares this year. Last year HSBC repurchased US$2.5 billion (HK$19.4 billion) worth of shares based on the 325.27 million shares that the group acquired from August 4 to December 19, 2016. The buybacks last year were made at progressively higher prices from HK$52.92 to HK$66.50 each or an average of HK$59.63 each. The repurchases since August 2016 are the group’s first buybacks based on filings on the Exchange since 1992. The blue chip closed at HK$63.55 on Friday.

Paper packaging of beverages and filling machines manufacturer and distributor Greatview Aseptic Packaging Company recorded its first buyback since January 2016 with 432,000 shares purchased on February 23 at HK$3.75 each. The trade was made on the back of the 13 per cent drop in the share price since October 2016 from HK$4.29. Despite the fall in the share price, the counter is still up since February 2016 from HK$3.17. The company previously acquired 3.05 million shares in January 2016 at HK$3.65 to HK$3.38 each or an average of HK$3.52 each and 7.8 million shares from August to December 2015 at HK$4.00 to HK$3.29 each or an average of HK$3.65 each. The repurchases since August 2015 are the company’s first buybacks since listing in December 2010. The stock closed at HK$3.77 on Friday.

The Capital Group Companies and CEO Mark Edward Tucker recorded buys in insurance and financial services provider AIA Group. The Capital Group acquired shares at lower than its sale price in August 2016 with a net 1.25 million shares purchased from February 15 to 17 at HK$47.55 to HK$48.69 each. The trades increased its holdings to 965.921 million shares or 8.01 per cent of the issued capital. The shareholder also reported a purchase-related filing on February 14 of 516,000 shares at HK$47.20 each. The notices this month were made on the back of the drop in the share price since October 2016 from HK$53.95. The group previously reported a disposal-related filing in August 2016 of 5.2 million shares at HK$48.80 each. Prior to that sale, the fund manager acquired a net 94.74 million shares from September 2012 to October 2013 at HK$30.35 to HK$38.41 each and an initial filing in September 2012 of 501.86 million shares via off-market trade at an undisclosed price, which raised its interest by 200 per cent to 6.26 per cent. Overall, The Capital Group’s stake is up by 28 per cent since that initial filing in September 2012.

CEO Mark Tucker, on the other hand, acquired 200 shares on February 15 at HK$47.51 each, which boosted his stake to 25.513 million shares or 0.21 per cent. He previously acquired 200 shares on January 16 at HK$46.63 each, 1,000 shares from August to December 2016 at HK$51.78 to HK$44.10 each or an average of HK$50.40 each and 1,600 shares from January to July 2016 at HK$38 to HK$47.86 each or an average of HK$44.94 each. Prior to his trades since 2016, Tucker acquired 2,500 shares from January to December 2015 at HK$53.68 to HK$43.15 each or an average of HK$48.60 each and 464,000 shares from October 2010 to December 2014 at HK$22.36 to HK$45.44 each or an average of HK$23.28 each. Tucker joined the company in July 2010. Investors should note that the stock rose by an average of 7 per cent six months after the CEO bought shares based on 61 purchases since 2010. The stock recorded a price gain six months after on 79 per cent of those acquisitions. The stock closed at HK$48.75 on Friday.

Independent non-executive director Alan Lam Kwing Tong and non-executive director Simon Lam Sing Kwong recorded their first on-market trades in generic drugs and proprietary Chinese medicines manufacturer and trader Jacobson Pharma Corp since the stock was listed in September 2016 with a combined 364,000 shares purchased from February 6 to 17 at an average of HK$1.70 each. The purchases were made on the back of the 17 per cent rise in the share price since November 2016 from HK$1.45. Independent non-executive director Alan Lam purchased 200,000 shares from February 16 to 17 at an average of HK$1.69 each, which increased his holdings by 122 per cent to 364,000 shares or 0.02 per cent of the issued capital. Lam joined the group in August 2016. Non-executive director Simon Lam, on the other hand, acquired an initial 164,000 shares from February 6 to 8 or 0.01 per cent at an average of HK$1.71 each. Lam was appointed to the board in April 2016. The directors’ purchase prices were near the initial public offering price of HK$1.72. Investors should note that executive director Pun Yue Wai acquired an initial 1.220 million shares when she was appointed to her post on February 1 at HK$1.55 each (Pun was appointed as executive director on February 1 but joined the group in 1998). The shares bought represented 0.07 per cent of the issued capital. The stock closed at HK$1.72 on Friday.

CEO Ip Yuk Keung recorded more buys in hospitality investment trust Langham Hospitality Investments at higher than his acquisition price in November 2016 with 500,000 units purchased on February 16 at HK$3.36 each. The trade increased his holdings by 33 per cent to 2.015 million units or 0.1 per cent of the issued capital. The acquisition was made after the company announced on February 14 a 71.6 per cent drop in year-end profit attributable to holders of share stapled units to HK$409.6 million. He previously acquired 500,000 units in November 2016 at HK$3.10 each. The purchases since November 2016 were made on the back of the rebound in the unit price since February 2016 from HK$2.43. Prior to his purchases since 2016, the CEO acquired an initial 1.015 million units from July 2014 to September 2015 at HK$3.70 to HK$2.85 each or an average of HK$3.44 each.

Ip was appointed to the board in June 2014. Investors should note that chairman Lo Ka Shui purchased 187,000 units from November 4 to 16, 2016 at an average of HK$3.08 each, which boosted his stake to 1.333 billion units or 64.52 per cent. He previously acquired 60,000 units in September 2016 at HK$3.07 each and 400,000 units in August 2016 at an average of HK$3.03 each. Prior to his trades since August 2016, the chairman acquired 413,000 units in July 2016 at an average of HK$2.74 each, 15.24 million units in May 2016 at an average of HK$2.59 each and 3.95 million units in February 2016 at an average of HK$2.47 each. The unit trust closed at HK$3.31 on Friday.

Robert Halili is managing director of Asia Insider