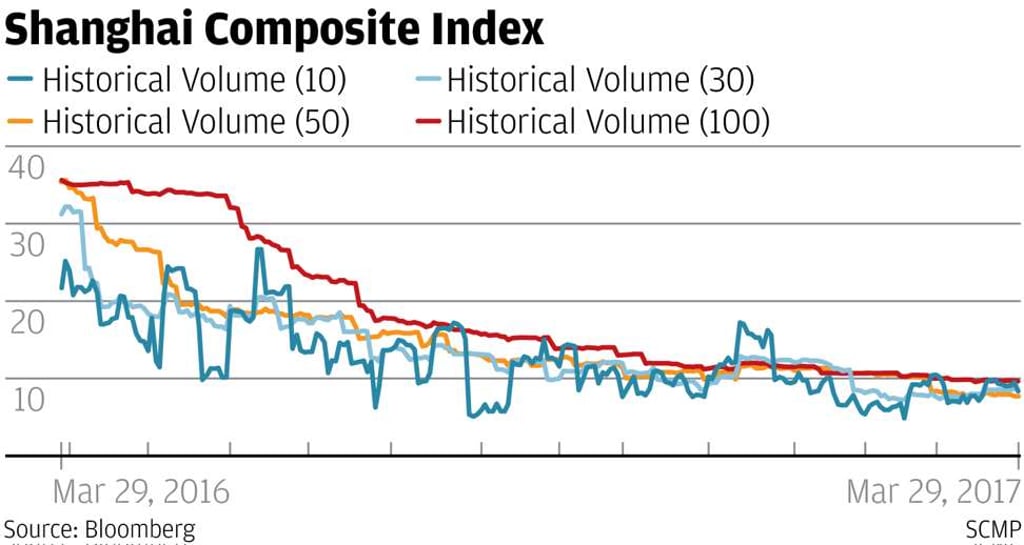

Shanghai’s low stock market volatility mystery

Monthly swings on China’s benchmark stock index have been decreasing since the equity bubble burst in 2015

China’s stock market has been so tame over the past year.

The monthly swings for the benchmark Shanghai Composite Index were less than 8 per cent in the period, compared with an average of 9.4 per cent since 2010 based on statistics from Haitong Securities. The gauge’s fluctuation is only 2.8 per cent so far in March.

Volatility of Chinese stocks has been decreasing since the equity bubble burst in 2015, wiping out nearly US$5 trillion in market value, and after a now-defunct circuit breaker system triggered a 23 per cent plunge in January last year. Tougher regulatory oversight against speculative trading, state intervention in equities and a weak economic recovery are cited as the main reasons for the subdued market by analysts and investors.

``The regulator’s strong law enforcement has curbed speculative trading and abnormal stock-price movements,’’ said Fu Jingtao, a strategist at Shenwan Hongyuan Group. ``Those who used to cause high volatility and fast turnover velocity have now disappeared from the market.’’

China’s stock market is usually known for wild boom-to-bust cycles as retail investors make up almost 80 per cent of trading, making price movements more volatile. The last big swing was from June to August in 2015, when the Shanghai Composite tumbled more than 40 per cent just after it more than doubled over the previous 12 months.

The market mayhem led to the resignation of Xiao Gang, former chairman of the China Securities Regulatory Commission, in 2016. His successor Liu Shiyu frequently reiterates the need to clamp down on malpractice to help maintain market order. In February’s annual regulatory meeting, he said the CSRC would go after some ``crocodiles’’ on the capital market to maintain stability. Two months earlier he lashed out at some insurers for bidding for controlling shares in listed companies through illegal fund-raising.