Bad loans continue to haunt mainland lenders despite better-than-expected showing in first quarter

Bad loan ratio remained unchanged at 1.74pc at the end of March, down from a recent high of 1.76pc in the third quarter of last year

Non performing bank loans (NPL) could continue to haunt lenders in mainland China as they remain at worrying levels , and the trend will continue to haunt the sector this year despite a better-than-expected showing in the first quarter, analysts said.

“Looking ahead, we expect the bad loan ratio to rebound slightly, but bad loans will keep mounting,” said Zhao Yarui, a senior researcher at Bank of Communications, quoting factors including slower economic growth and limited space for banks to increase write-offs due to pressure to meet NPL provision coverage requirements.

Technically, a NPL is borrowed money upon which the debtor has not made his scheduled payments for at least 90 days.

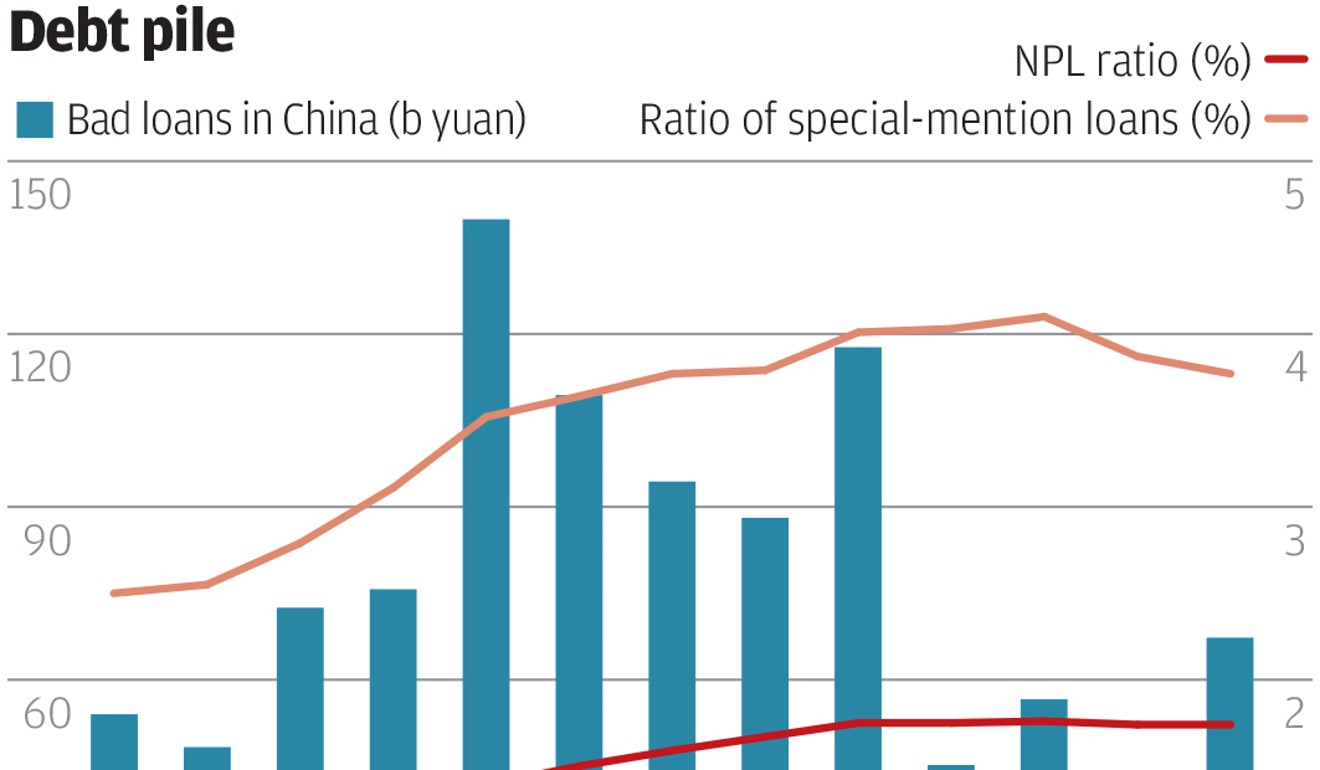

The bad loan ratio at mainland commercial banks remained unchanged at 1.74 per cent at the end of March, compared with the previous quarter, according to fresh data from the China Banking Regulatory Commission (CBRC), down from a recent high of 1.76 per cent in the third quarter of last year.

Bank of Communications expects the NPL ratio to grow to 1.8 per cent by the end of this year, or even 1.9 per cent if economic growth falls short of expectation, quoting major sources of bad loans such as smaller business and sectors hit hard by the nation’s de-stocking measures including steel, cement, construction materials.

The CBRC data showed sour loans grew by a whopping 67.3 billion yuan in value in the first quarter, compared with growth of 18.3 billion yuan in the fourth quarter of 2016 or a quarterly average of 59.5 billion yuan throughout last year.

Yang Yue, a banking analyst at China Zheshang Bank, cautioned it’s still too early to conclude any turnaround is happening in worsening banking assets, despite latest data showing signs of periodical stabilising.

“Banks could still face growing pressure from worsening asset quality, amid uncertainties of economic growth at home and abroad, and further risk exposure in the real estate sector amid increasingly tighter controls on property pricing inflation in major cities,” he said.

In addition, the recent regulatory scrutiny to deleverage financial institutions could also expose problems and increase risks for banks, he added.

UBS said earlier in a research note that recent financial deleveraging could lead to a rise in credit problems, excessive liquidity tightening, a faster-than-intended slowdown in credit growth, and greater market volatility short term, despite being “undoubtedly good for the long-term health of the financial system”.

Meanwhile, the relatively high ratio of special mention loans, potentially weak loans or assets presenting unwarranted credit risks, and signs of accelerating transferring of impaired loans, also mean banks can expect growing bad loan pressure, the analysts said.

China’s economy grew a better-than-expected 6.9 per cent in the first quarter. In 2016, the economy grew at a 26-year low of 6.7 per cent.