Predicting China’s endgame: financial crisis, lost decade or soft landing?

The first in a series of three articles looking at what lies ahead for the world’s second biggest economy

Rising economic imbalances and persistent growth slowdown have made China a major concern for investors in recent years.

Such concern has been propagated globally by the liberalisation of the country’s capital account and financial markets. Some fear that a sudden and calamitous unwinding of these structural imbalances could spell disaster for the world.

Thanks to the wealth of research available, most investors have by now gained a decent knowledge of China’s structural problems. A debt-laden economy, with an unsustainable growth model; a troubled financial system plagued by non-performing loans and shadow banking risks; a large but closed capital market that is unable to channel liquidity efficiently; and a population base that is ageing at an alarming pace. These are just some of the challenges facing the world’s second largest economy that, as some fear, could terminate its growth miracle prematurely.

Some fear that a sudden and calamitous unwinding of [China’s] structural imbalances could spell disaster for the world

In contrast to the awareness of the problems, little attention has been paid to possible solutions. As a consequence, there is a wide spectrum of expectations on China’s future paths. The perma-bears, for example, have been calling for an imminent financial crisis for some time, while optimists still think a “V or U” shaped rebound is possible. In between, there is the mainstream market which has bought into the idea of an “L”-shaped trajectory, popularised by a policy insider – the “authoritative person” – last year.

In the next three updates of this column, we will try to look into our crystal ball and see what may be lying ahead for China. To do this, we compare its situation today with those economies that made the classic mistakes in addressing their own structural imbalances in the past.

While a comparative analysis of this sort is not new, what separates our analysis from the existing literature is an intense focus on China’s unique economic, social and political characteristics, which we think may allow it to avoid the perils that befell others and chart its own course for the future.

To kick off this analysis, we first examine the prevailing market expectations of what China’s endgame may look like. The most popular views can be summarised in three categories:

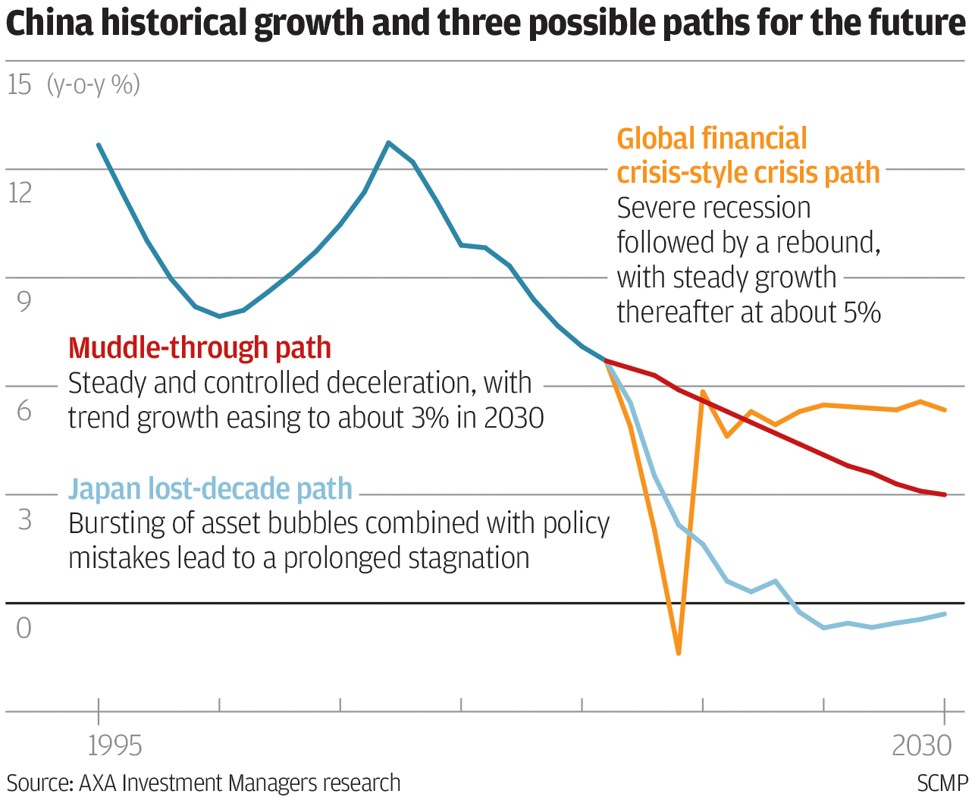

1. A US-style financial crisis: where China reaches a tipping point in its structural imbalances, triggering a violent adjustment that inflicts severe pain on its economy and financial system. This is akin to the experience of the US following the fallout from the collapse of Lehman Brothers during the global financial crisis.

3. A soft landing or “muddle-through”: in this scenario, the structural imbalances get unwound gradually, asset bubbles are deflated in a non-crisis fashion, and the economy slows incrementally to a new equilibrium. The health of the system gets restored, not by market forces (hence there are no crises nor lost decades) but by effective macro policies. This is a scenario preferred by China, and is what Beijing is trying to engineer for the future.

The chart below shows what these three scenarios imply for the future of the Chinese economy. For the crisis and lost decade cases, we examine how the US and Japanese economies fared during and after the 2008 subprime crisis and the early-90s bubble burst. Two hypothetical growth projections are created mimicking their experiences, while taking into account China’s own growth characteristics. The third “soft-landing” path – for a lack of obvious comparison – simply assumes the economy slows incrementally over time towards a trend growth of about 3 per cent by the 2030s.

As for the lost decade scenario, China would see its growth plummeting to snail speed, with no recovery in sight. This means the economy would stop converging to the world’s rich and fall into a mid-income trap. Such a fate could have far-reaching implications for China’s economy, its political system and social stability.

Can China avoid the mistakes of the US and Japan, and spearhead a more benign path out of its structural impediments? In our next two updates, we will systemically compare China today with the US and Japan before their crises, discussing the well known similarities but also uncovering the important differences that may lead China to a different destiny. Stay tuned.

Aidan Yao is senior emerging Asia economist at AXA Investment Managers