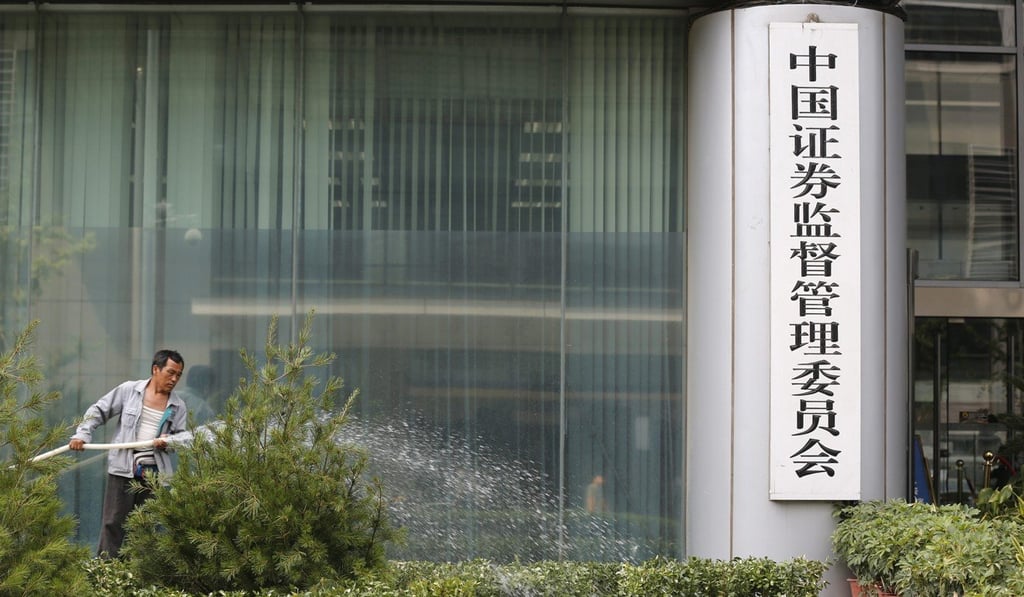

China’s IPO approvals nosedive as regulator raises review threshold

The CSRC is giving a bigger priority to accuracy and authenticity of corporate disclosures when vetting IPO applications

It has been a week of rejections where China’s securities regulator would have set a record of vetoing companies seeking to list.

The new listing committee under the China Securities Regulatory Commission (CSRC) rejected six out of nine firms seeking initial public offerings (IPO) on the mainland’s stock exchanges in three review meetings this week, according to the vetting results posted on the regulator’s website.

The 33.3 per cent approval rate is sharply lower than the average 77.5 per cent so far this year, and the 89.8 per cent for the whole of 2016, according to data from Shanghai-based brokerage Shenwan Hongyuan Group.

While President Xi Jinping stressed the need to raise direct financing to serve the real economy in his work report to the national party congress last month, the securities regulator is quietly raising the bar for letting companies sell new stocks on the equity market amid a twofold increase in IPO shares this year.

“Earnings are not the key problem,” said Lin Jin and Peng Wenyu, analysts at Shenwan Hongyuan.

“The major problems for the rejected companies lie in earnings sustainability, internal controls, abnormal accounting numbers and rational use of IPO proceeds.”